Original KATY B?RNER and other intelligence clubs.

introduction

With the progress of science, the research on citation network, research results, science policy and so on has attracted more and more attention, and gradually formed an interdisciplinary subject-the Science of Science. In 2018, many scholars led by Albert-László Barabási, a network scientist, published a heavy review in Science, which comprehensively introduced this "high-level discipline" from the interdisciplinary methods of scientology and the guidance of scientology to improve scientific research productivity.

Santo Fortunato, Carl T. Bergstrom, Katy Brner et al | Author

Chen Xi |

Cui Haochuan | proofreading

Wangyi Lin, Deng Yixue | Editor

catalogue

I. Structure Summary

1. Background

2. Progress

Step 3 look ahead

Second, the text

1. Summary

2. A network of scientists, scientific research institutions and scientific research ideas.

3. Selection of research questions

4. Innovation

5. Dynamics of scientists’ academic career

6. Team research

7. The dynamics behind the cited quantity

8. Outlook

Attachment: References

I. Structure Summary

1. Background

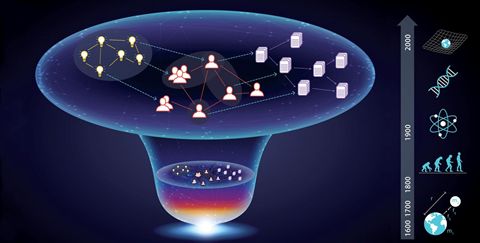

Nowadays, with the increasing digital access to the whole process of scientific research, including scientific research fund support, academic production, scientist cooperation, citation of articles and career movement of scientists, people have gained unprecedented opportunities to explore the structure and development of science. The science of science (hereinafter abbreviated as SciSci) provides a quantitative understanding of the interaction between scientific units with different space and time scales: it allows us to understand the conditions behind "creativity" and the process of scientific discovery, and its ultimate goal is to develop a series of policies and tools that can accelerate scientific research.

In the past ten years, science of science has attracted scientists from natural, computer and sociological research backgrounds. Together, they built scientific research big data for empirical analysis and generation model research to capture the productivity behind science and the development and changes of practitioners. Scientology hopes to understand and promote various factors in scientific research more deeply, so as to solve environmental, social and technical problems more effectively.

Science can be regarded as an expanding and evolving network of ideas, scholars and papers. Science of science explores the universal laws of universal or specific fields based on scientific structure and dynamics.

2. Progress

Science can be described as a complex, self-organizing and evolving network. It consists of scholars, papers and ideas. This method of describing the problem explains many potential models, for example, the study of cooperative networks and the study of citation networks explain the birth of new disciplines and the birth of major discoveries. The microscopic model tracks the dynamics of citation accumulation, which enables us to predict the influence of a single paper in the future.

Scientology reveals the choices and trade-offs that scientists face in expanding their careers and scientific horizons. For example, the analysis shows that scholars don’t like risks and prefer to study topics related to their current professional knowledge, which limits their potential for future discovery. Those who are willing to break this pattern will engage in higher-risk careers, but they are more likely to make major breakthroughs.

In a word, the most innovative science is based on the traditional combination of disciplines, but this combination is often unprecedented. Finally, with the shift of research work from individuals to teams, scientology pays more and more attention to the influence and significance of teams in scientific research. Some studies have found that revolutionary ideas are usually born in small teams. In contrast, large teams tend to advance research in frontier areas and gain high but usually short-term influence.

Step 3 look ahead

Scientology provides a quantitative understanding of the structural framework among scientists, research institutions and ideas. It helps to identify the basic mechanism behind scientific discovery. These interdisciplinary data-driven contents supplement the contents of scientometrics and related fields such as economics and sociology of science.

Although scientology is eager for long-term universal laws and mechanisms applicable to all scientific fields, it first needs to face the inevitable differences in culture, habits and preferences between different fields and countries. This change makes it difficult to understand some cross-disciplinary opinions and implement relevant scientific policies. The differences between scientific research problems and data are generally related to the field, which also implies that the research of science of science will change accordingly in the future because of "subject characteristics"

Densification of scientific boundaries is also a signal of interdisciplinary exploration, integration and innovation.

Second, the text

1. Summary

Identifying the driving force behind scientific development and constructing a model that can capture scientific development can guide people to design policies to promote scientific progress. For example, by strengthening the policy design of scientists’ career path, better scientific performance evaluation, more effective funding design, and even identifying the frontier research that will be born. Scientology uses large-scale data about scientific production to find the laws and patterns of universal and specific disciplines. Here, we review the latest development of the interdisciplinary field of science of science.

A large number of digital data about academic output provide an unprecedented opportunity for exploring the model to characterize the structure and evolution of science. Scientology puts the process of scientific development under a microscope and has a quantitative understanding of the origin of scientific discovery, creativity and practice. It can develop tools and policies to accelerate scientific progress.

The emergence of scientology is driven by two key factors.

The first is the availability of data. In addition to the proprietary Web of Science(WoS), it is the first citation index with a long history, and there are many data sources today (Scopus, PubMed, Google Scholar, Microsoft Academic, US Patent and Trademark Office, etc.). Some of these sources are provided free of charge, covering millions of data points related to scientists and their achievements, which come from all walks of life, north and south.

Secondly, scientology benefited from the influx and cooperation of natural, computational and social scientists, who developed data-based tools to enable key tests to run on generative models, aiming at revealing the phenomena discovered by science, their internal mechanisms and driving forces.

One of the highlights of this emerging field is the process of breaking the boundaries of disciplines. Scientology integrates research findings and theories from multiple disciplines and uses a wide range of data and methods.

From scientometrics, I learned the methods of analyzing and measuring large-scale data sets. From sociology of science, it learned some theoretical concepts and social processes; From innovation research, it explores ways from scientific discovery to invention and economic change.

Science of science depends on the integration of a wide range of quantitative methods, from descriptive statistics and data visualization to advanced econometric methods, network science methods, machine learning algorithms, mathematical analysis and computer simulation, including agent-based modeling.

The value proposition of scientology is based on the assumption that with the in-depth understanding of the factors behind successful scientific breakthroughs, we can grasp the scientific research progress as a whole, so as to solve social problems more effectively.

2. A network of scientists, research institutions and ideas.

Contemporary science is a dynamic system driven by the complex interaction among social structure, knowledge representa-tions and the natural world. Scientific knowledge consists of concepts and relationships in research papers, books, patents, software and other artificial products in academic fields. These contents are classified into disciplines and broader fields according to distance and closeness. These social, conceptual and material elements are interrelated through formal and informal information, ideas, scientific research practices, tools and case information flows.

Therefore, science can be described as a complex, self-organized and developing multiscale network.

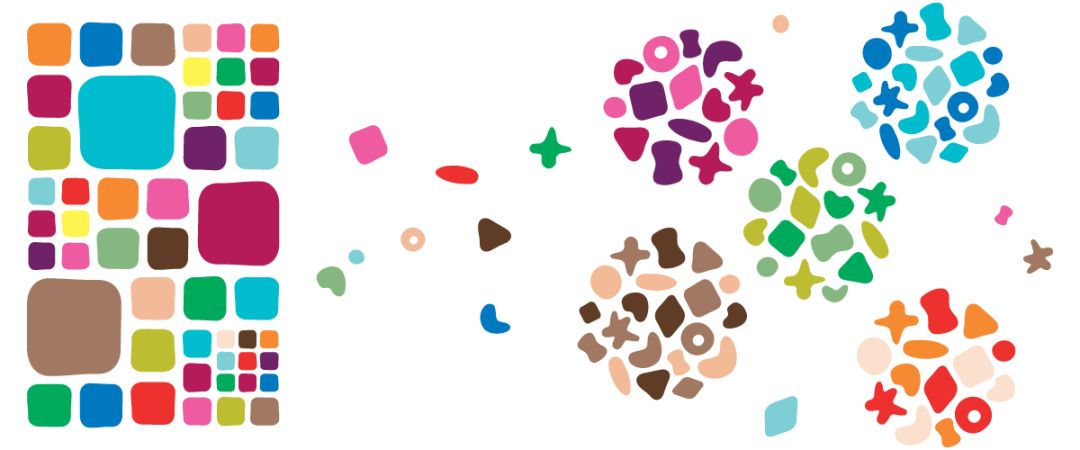

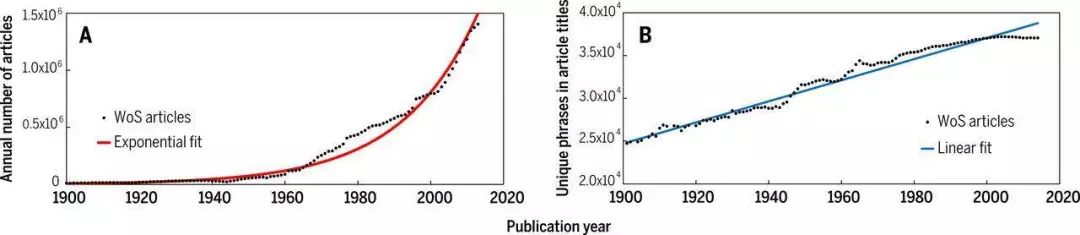

Early research found that the number of scientific documents accumulated exponentially with time (2), and the number of documents would double in an average of 15 years (Figure 1). However, don’t think that scientific ideas have multiplied with the number of documents. The technology and economy of the publishing industry have also improved with time, and the production efficiency of published articles has also improved. In addition, newly published articles in the field of science tend to gather in different knowledge fields (3).

Through large-scale text analysis, researchers use phrases extracted from titles and abstracts to measure the cognitive degree of scientific literature. They found that the scope of scientific concepts expanded linearly with time. In other words, although the number of published articles increases exponentially, the new concept is that it increases linearly with the passage of time, as shown in Figure 1. (4)

Figure 1 The growth of science. (a) Extract the relationship between the annual output of literature and time in WoS database. (b) The growth of new scientific discoveries covered by indexed documents in B)WoS. This is determined by counting the number of concepts in a fixed number of articles (4).

Words and phrases commonly used in article titles and abstracts spread through citation networks, forming a pattern, which will be replaced by new paradigms at some time (5). By applying the network science method to the citation network, researchers can identify the communities corresponding to the subsets of published articles that frequently quote each other (6). These communities usually correspond to groups of authors (7) who share a common position on specific issues or practitioners (8) who work on the same specialized scientific topics. Recently, an article focusing on biomedical science shows how the growth of publications has strengthened the "subject community" (9).

Once a new paper is published, the relationship between scientists, drugs, diseases and methods ("these things" are nodes in network analysis), that is, hyperedge in network analysis, will be updated and strengthened. Most newly established links are only one or two steps away from each other, which means that when scientists choose new research topics, they prefer to choose content directly related to the current professional knowledge or the professional knowledge of their collaborators. This densification shows that the existing scientific structure may limit people’s research content in the future.

Densification of scientific boundaries is also a signal of interdisciplinary exploration, integration and innovation.

The life cycle analysis of eight research fields (10) shows that successful fields have gone through the process of knowledge and social unification, which leads to a huge channel in the collaborative network (104), which can be compared with a large group of co-authors under normal conditions. The mathematical model in which a scientist random walks to choose a collaborator on the cooperative network successfully reproduces the productivity of the author, the number of authors in each discipline, and the interdisciplinary nature between the content of the paper and the author (11).

3. Selection of research questions

How do scientists decide which research problems to study? Scientific sociologists have long speculated that these choices are determined by the tense game between the risks of traditional research and innovation (12, 13). Scientists who adhere to the tradition of research in their fields will usually promote the research process of key topics by publishing a series of steady research results, thus appearing fruitful.

However, focusing too much on a topic may limit researchers’ ability to perceive and seize opportunities. These opportunities can find new ideas to promote the development of this field. For example, a case study on the relationship between biomedical scientists’ choice of new chemicals and existing chemicals shows that with the maturity of research field, researchers pay more and more attention to existing knowledge (3).

Although innovative articles often have a greater impact than conservative articles, high-risk and high-innovation strategies are rare, because extra rewards can’t make up for the risk of publishing failure. Awards and honors seem to be the main incentives to resist conservatism. They can break the tradition and give people new surprises. Although there are many factors that affect the work that scientists have to do, the macro-model of controlling the change of research interest in scientific undertakings is obviously traceable, and these laws are hidden in the career path of scientific research and scientists. (14)。

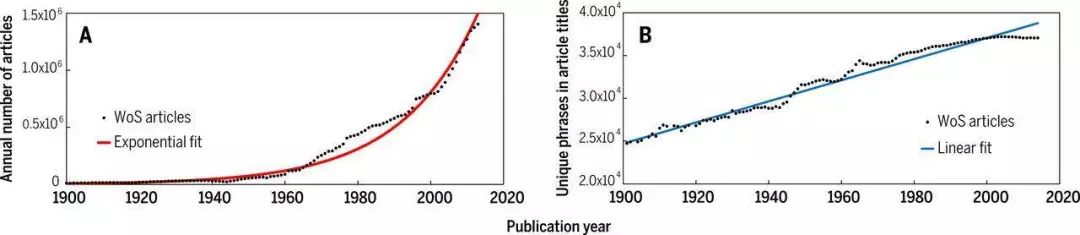

Scientists’ choice of research topics mainly affects their personal careers and the careers of those who depend on them. However, the decision-making of scientists sometimes plays a greater role in determining the direction of scientific discovery (Figure 2). Conservative research strategies mean that (15) personal career development has a stable and good prospect, but the promotion effect on the whole discipline is poor. This strategy is magnified by a phenomenon called file drawer problem (16): results inconsistent with established assumptions are rarely published, leading to systematic bias of published research. The untenable and false content is sometimes even regarded as a classic (17).

File drawer problem:

Refers to the researcher’s bias in selecting references, and the documents that do not meet the research purpose will stay in the drawer instead of taking them out for reference.

More bold hypotheses may have been tested by generations of scientists, but only those who are successful enough to produce articles can be known to us. One way to solve this conservative trap problem is to urge funding agencies to actively sponsor risk projects that test new hypotheses, so that special interest groups can undertake research on special diseases.

The results of quantitative analysis show that the distribution of biomedical resources in the United States is related to historical distribution and research, rather than to the severity of actual diseases (18), pointing out the systematic dislocation between biomedical needs and resources. This dislocation makes people wonder to what extent these funds run by scientists with solid habits can affect the development of science without additional supervision, encouragement and feedback.

4. Innovation

The analysis of articles and patents proves that the rare combination of scientific discovery and invention tends to get higher citation rate (3). Interdisciplinary research is a symbolic reorganization process (19); Therefore, the successful combination of historically irrelevant ideas and resources is very important for interdisciplinary research, which is often counterintuitive and leads to highly influential new ideas (20). However, the evidence from the fund application shows that when faced with truly novel (21-23) or interdisciplinary (24) research topics, the expert evaluation system usually gives lower scores.

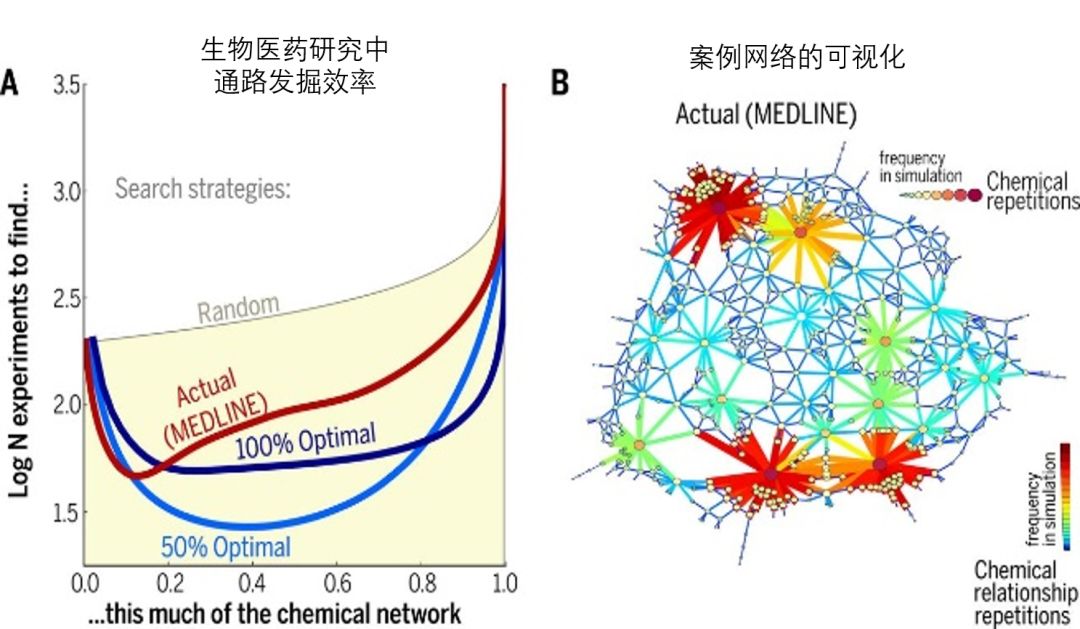

Figure 2 Choose the experiment to accelerate collective discovery.

(a) A study measured the discovery efficiency of all new drugs published in MEDLINE in 2010. The model does not consider the difference in difficulty or cost of specific experiments. The efficiency diagram of this global scientific strategy reflects the relationship between the newly published new biochemical pathway (horizontal axis) and the average number of experiments (vertical axis). Correspondingly, the network diagram between drugs can be made. The researchers used all kinds of hypothetical strategy efficiency to compare with the actual situation, and found the optimal strategy of the best network with complete randomness and 50% and 100%. A lower value on the vertical axis indicates a more effective strategy, and the mode of new discovery is not optimal. The actual strategy is most suitable for discovering 13% of chemical networks, while the 50% optimized strategy is effective for discovering 50% of chemical networks, but both of them are not as good as the 100% best strategy for revealing the whole network.

(b) In reality, drug discovery networks can be plotted in the form of charts. The new connection born by this strategy is the research around some "important" and highly related chemicals, such as the hot spots in the picture, but the 100% efficient research strategy shows a more uniform discovery law and is unlikely to "follow the crowd" in the space of scientific possibility. (15)

The most influential scientific work mainly comes from the combination of conventional content, but it also comes from the unusual combination (25-27). This type of paper is twice as likely to get a high citation rate (26). In other words, the mixture of new and existing elements is the safest way to succeed in scientific progress.

5. Dynamics of scientists’ academic career

Under the broad market background of knowledge production and utilization, various academic professions have emerged (28). Therefore, scientific professional achievements are not only studied in terms of individual motivation and marginal productivity (relative gain and energy) (29), but also tested in terms of institutional motivation (30,31) and competition (32). It is necessary to combine large-scale metadata)(33) of individuals, geography and time with high content resolution to construct a career trajectory that can be analyzed from different angles. For example, a study found that funding schemes that tolerate early failures (rewarding long-term success) are more likely to produce influential published articles than funding for short-term review cycles (31).

Competitive interactive system with time scale is a classic problem in complex system science. The multi-angle nature of science is the driving force to generate a model, which can highlight the unexpected consequences of policies. For example, the career development model shows that short-term contracts are an important reason for productivity fluctuations, because it usually leads to the sudden end of a career.

The difference in productivity and career length can explain the difference in cooperation mode (38) and recruitment rate (35) between male and female scientists. On the other hand, experimental evidence shows that prejudice against women occurs in the early stage of career. When gender is randomly assigned in the resumes of a group of applicants, the recruitment committee systematically belittles the achievements of female candidates (40).

Up to now, most studies have focused on relatively small samples. Improving and compiling large-scale scientists’ data sets and using information from different sources (for example, publishing records, funding applications and awards) will help to understand the causes of inequality more deeply. Establish a motivation model that can provide information for policy solutions.

The mobility of scientists is another important factor in providing diversified career opportunities. Most researches on talent mobility focus on quantifying the inflow and outflow of talents in countries or regions (41,42), especially after policy changes. However, there is still little research on personal mobility and its career impact, mainly because it is difficult to obtain longitudinal information about scientists’ migration and the explanation of the reasons behind the mobility decision.

According to the number of articles cited, it is found that scientists who have left their country of origin perform better in the number of articles cited than those who have not left. This may stem from a choice preference: a good scholar (who has the ability to go abroad) can easily get a better position (a stronger team). (43,44)。 In addition, scientists tend to move between institutions with equal reputations (45). However, when quantifying the impact of job-hopping by citing, no increase or decrease in the system is found, even if the scientist moves to a relatively high or low-level institution (46). In other words, it is not the institution but the individual researchers who make up the institution that have an impact.

Another potential factor affecting career is reputation, and the dilemma it brings to the starting point of reviewing literature, evaluating proposals and making decisions. The reputation of the author, measured by the total citation of its previous output, can significantly increase the number of citations of the paper in the first few years after publication (47). However, after this initial stage, the impact depends on the scientific community’s acceptance of the work. This discovery and the work in citation (46) show that reputation is not the primary productive force for fruitful scientific undertakings, but hard work, talent and advancing despite difficulties are the driving factors.

A policy-related question is whether creativity and innovation are related to age or career stage. After decades of research on outstanding researchers and innovators, it is believed that the major breakthrough occurred in a relatively early stage of career, with a median age of 35 (48).

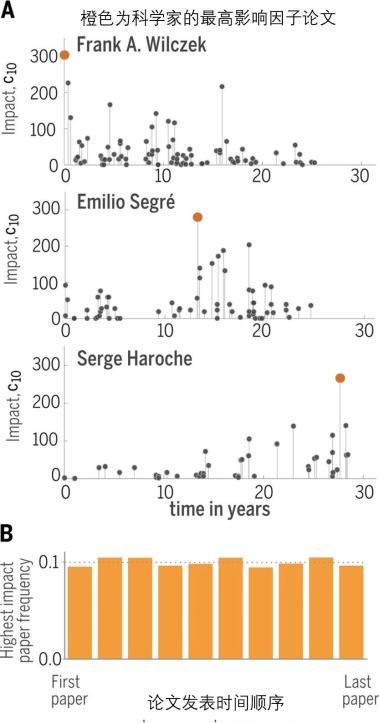

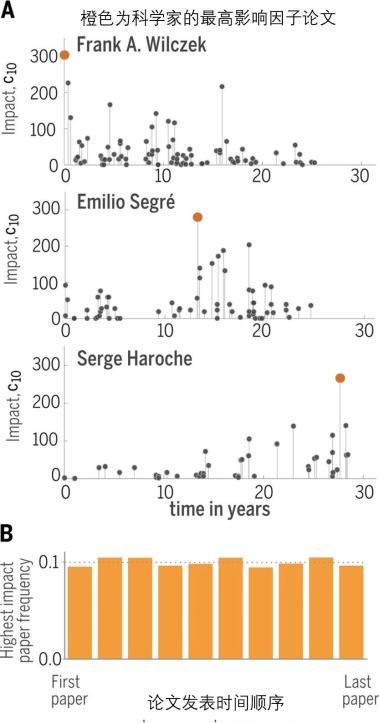

However, recent work shows that this tendency of fully recording early career discovery is completely explained by the tendency of productivity, which is very high in the early stage of a scientist’s career and then declines (49). In other words, there is no age pattern in innovation: the paper most cited by a scholar can be any of his or her papers, regardless of the age or career stage at the time of publication (Figure 3). The stochastic model describing the development of influence also shows that the breakthrough is produced by the combination of scientists’ ability and the selection of problems with high potential, intuition and luck (49).

Fig. 3 The influence of science of science on science profession

(a) Publication records of three Nobel Prize winners in physics. The horizontal axis represents the number of years after the winners first published their articles, each circle corresponds to a research paper, and the height c10 of the circle represents the influence of the paper, which means the number of citations after 10 years. The highest impact papers of the winners are indicated by orange circles.

(b) Histograms of papers with the highest impact in the sequence of papers by scientists, calculated for 10,000 scientists. The flatness of the histogram shows that in the sequence of papers published by scientists, the time when the most influential work appears may have the same probability (49).

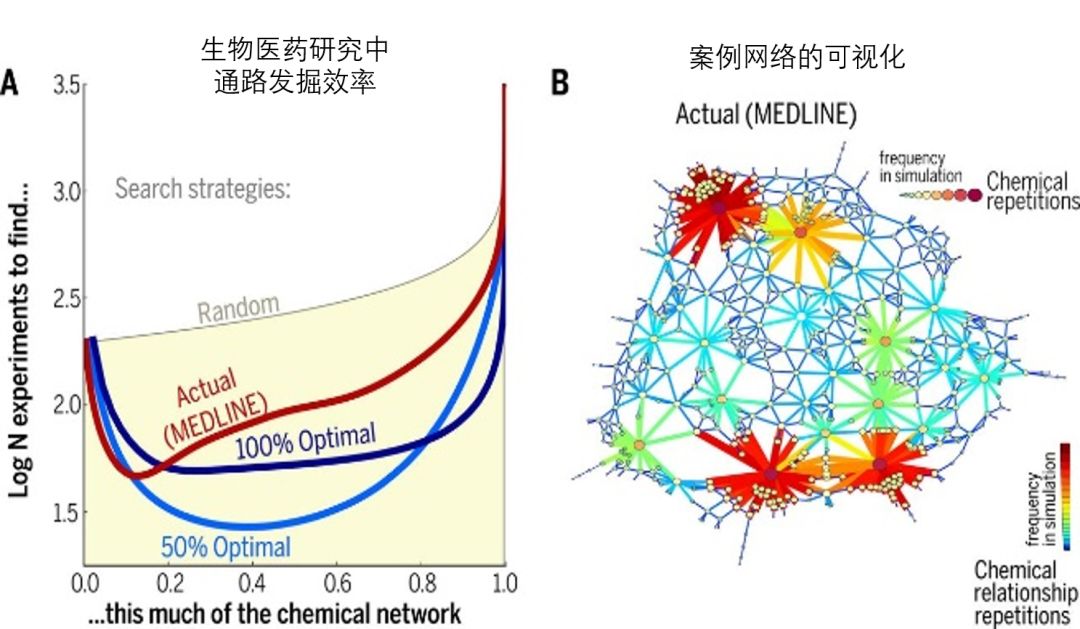

6. Team research

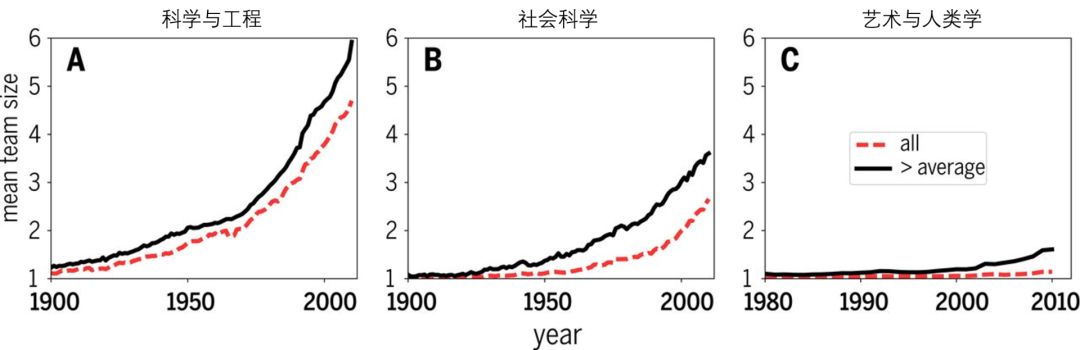

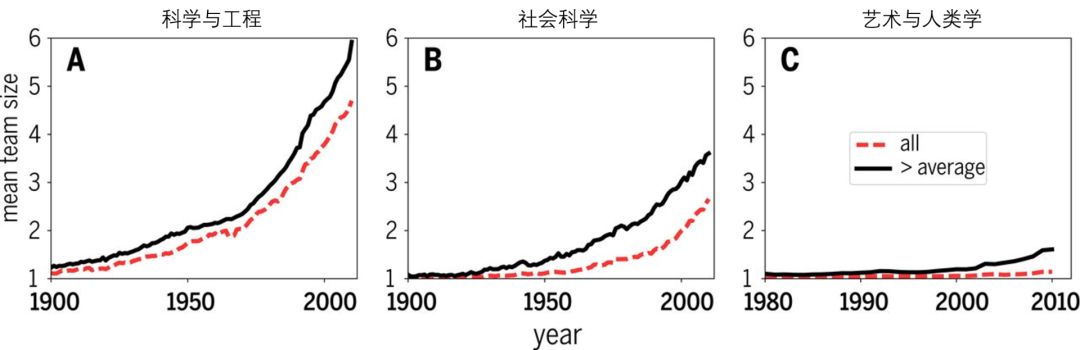

In the past decades, the dependence of scientific research on teamwork has increased day by day, which represents a fundamental change in the way of scientific research. A study of authors of 19.9 million research papers and 2.1 million patents found an almost universal trend of teamwork in scientific research (50) (Figure 4). For example, in 1955, the scientific and engineering team wrote the same number of papers as a single author. However, by 2013, the proportion of papers written by teams increased to 90% (51).

Nowadays, papers written by scientific and engineering teams are 6.3 times more likely to get more than 1,000 citations, or more citations than individual papers. This phenomenon cannot be explained by self-citations (50,52). One possible reason is that the team can come up with more novel combinations of ideas (26) or produce resources that other researchers can use later (for example, genomics).

The data shows that the team is 38% more likely to combine the scientific breakthrough content into the familiar knowledge field than the individual author, which proves the premise that the team can combine different majors together, thus effectively promoting the scientific breakthrough. Having more collaboration means increasing the visibility among scholars through more co-authors, so they may introduce each other’s work into the internal network of scientific research, which means that each researcher should share his reputation with his colleagues (29).

Figure 4 Team size and impact

In the past century, the average team size has been steadily expanding. The red dotted line represents the average number of co-authors in all papers; The black curve considers the average team size of articles with more citations than the average in the field. The black curve is systematically above the red dotted line, which means that large teams are more likely to produce high-impact work than small teams. Each chart corresponds to a discipline category specified by WoS (a) science and engineering, (b) social science, and (c) arts and humanities.

On average, researchers from large teams can get more citations in various fields. Research shows that small teams tend to change science and technology with new ideas and opportunities, while large teams promote the existing research process (53). Therefore, it may be important to finance and train teams of all sizes to ease the bureaucracy of science (28).

At the same time, the team size is increasing at an average rate of 17% every ten years (50, 54, 105). This trend has changed because of the underlying structure of the team. Scientific teams include small, stable "core" teams and large teams, and dynamically expanding teams (55). The increasing team size in most fields is produced by the continuous expansion of dynamic expansion teams, which start with small core teams, but then attract new members through the original accumulation based on productivity. Scale is the key determinant of team survival strategy: if small teams maintain a stable core, they will survive for a longer time, but large teams can survive for a longer time by showing the mechanism of member mobility (56).

With the acceleration and complexity of science, the tools needed to expand the frontier of knowledge are increasing in scale and accuracy. For most individual investigators, research tools are too valuable, but so are most institutions. Academic cooperation has always been a key solution to this problem, so that resources can be more concentrated on scientific research.

The Large Hadron Collider at CERN is the largest and most powerful particle collider in the world. Its birth cannot be ignored by academic cooperation. More than 10,000 scientists and engineers from more than 100 countries participated in the establishment of this collision. However, with the increase of scale, the balance between value and risk related to "big science" comes into being (2). Although it can solve a bigger problem, the problem of scientific repeatability requires you to repeat the experiment, which may not be feasible in practice or economy.

Collaborators will have a great influence on science. According to recent research (57,58), a scientist who loses a star collaborator will experience a sharp drop in productivity, especially if the scattered collaborator is an ordinary researcher. The average number of citations of published articles with strong cooperators will increase by 17%, which shows the value of professional cooperation (59).

In view of the increasing number of authors in research papers, who should and does get the most reputation? The classic theory of the misallocation of reputation in science is Matthew effect (60), in which scientists of higher status who participated in cooperative work gained excessive reputation for their contributions. It is difficult to assign credibility to collaborative participants because individual contributions cannot be easily distinguished (61). However, it is possible to check the common patterns of co-author papers to determine the reputation assigned by each co-author in the group (62).

7. The dynamics behind the cited quantity

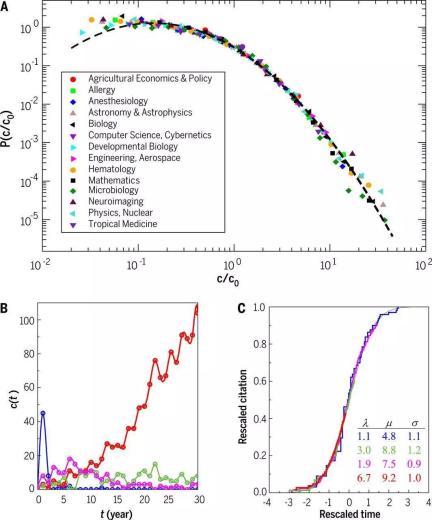

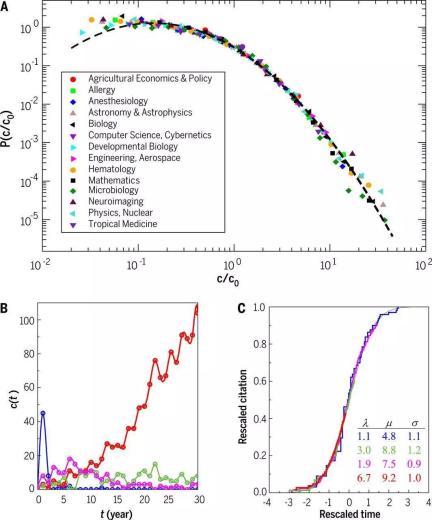

Academic citation is still the mainstream way to measure academic achievements in science. In view of the long-term dependence on mainstream citation standards (63-66), the dynamic law of citation accumulation has been verified by several generations of scholars. According to the pioneering research of Price(67), the distribution of citations in scientific papers is highly biased: many papers have never been cited, but pioneering papers can accumulate 10,000 or more citations. This uneven citation distribution is a powerful, natural and innovative attribute of scientific change. When papers are grouped by institutions, it also holds (68). And if the number of citations of a paper is divided by the average citations of the same year of the paper’s classmates, the score distribution obtained is basically the same for all disciplines (69, 70) (Figure 5A).

This means that the influence of papers published by different disciplines can be compared by looking at the relative references. For example, a mathematics paper with 100 citations has a higher academic influence than a microbiology paper with 300 citations.

Fig. 5 universality of citation dynamics

(a) If the citation frequency c of each paper is divided by the average citation frequency c0 of all papers in this discipline, then the citation distribution of papers published in the same discipline and year is basically uniform in all disciplines. The dotted line is a lognormal fitting curve. (69)

(b) The citation history of four papers published in "Physical Review" in B)1964, according to its unique dynamic selection, shows "jumping decay" mode (blue), peak delay (purple), stable citation number mode (green) and rising citation index (red). (c) The citation of a single paper is determined by three parameters: fitness λ, immediacy μ, and longevity σ. The citation of each paper in (b) is readjusted by appropriate (λ, μ, σ) parameters, and the four papers are merged into a general function, which is the same for all disciplines. (77)

The tail information of distribution can capture the number of high-impact papers and reveal the mechanism that drives the accumulation of citation numbers. Recent analysis shows that it follows the power law distribution (71-73). The tail of power law can be generated by the process of accumulating advantages (74), which is called preferential attachment)(75) in network science, indicating that the probability of citing papers increases with the increase of the number of citations it has accumulated.

Such a model can be used together with other characteristics of citation dynamics, such as the obsolescence of knowledge, to enhance the descriptive nature of the model. The number of articles cited decreases with time (76, 79, 106), or a fitness parameter can be used to correspond to the attraction of each paper to the scientific community (77,78). Only a small number of papers can’t be described by the above hypothesis, and they are called "Sleeping Beauty" because they were ignored for a period of time after publication, but after a period of time, they suddenly received a lot of attention and quotations (80,81).

The above formation mechanism can be used to predict the citation dynamics of a single paper. A prediction model (77) assumes that the citation probability of a paper depends on the number of previous citations, and the number of citations of this article can be predicted by considering the obsolescence factor and fitness parameter of each article (Figure 5, B, C). The long-term impact of a scientific research work can be inferred (77). Other studies have identified predictive indicators related to paper impact factors (82), such as journal impact factors (72). Some studies show that a scientist’s h-index(83) can be accurately predicted (84). Although if the career stage of scientists and the accumulation and non-decline of h- index are taken into account, the prediction accuracy will be reduced (85).

Behind eliminating the inconsistency of quantitative evaluation indicators and commonly used statistical data in science, the internal mechanism of generating these data is a very important mechanism in scientific research.

8. Outlook

Although scientific research does have its universality, the differences in substantive subject background in culture, habits and preferences make it difficult to understand some cross-disciplinary opinions in some fields, and the corresponding policies are difficult to implement. The differences between the questions, data and skills required by each discipline indicate that further insights can be obtained from scientific research in specific fields. These research simulations and predictions are adapted to the needs and opportunities in each subject area. For young scientists, the research results of scientology provide effective insights from past scientific research and help guide them to foresee the future (Box1).

Box1: Lessons from Science of Science

Innovation and tradition: pure, truly innovative and highly interdisciplinary ideas may not reach the scientific influence they can achieve. In order to enhance its influence, new ideas should be published in the existing academic environment (26).

Persistence: As long as the research status is maintained, there will never be a case that a scientist is "too old" to make a major discovery (49).

Cooperation: Now the research mode is shifting to teams, so it is beneficial to participate in cooperation. The works of small teams are often more subversive, while those strong teams often have more resources to do more influential big work (4,50,53).

Reputation: Most reputations will belong to co-authors who have consistently worked in the field of literature publishing (62).

Funding: Although the judging panel promises to support innovation, they are actually more inclined to ignore innovation. Funding agencies should ask reviewers to evaluate innovation, not just the success they expected in their minds (24).

The contribution of science of science of science of science of science is that it begins to understand the relationship structure among scientists, institutions and ideas in detail, which is the key starting point to identify the operating mechanism behind it. In a word, these data-driven works supplement the contents lacking in related research fields, such as economics (30) and sociology of science (60,86).

Causal estimation is a typical example in economics. Econometrics research will collect and use comprehensive data sources to simulate the needs (31,42). Evaluating causality is one of the most needed future developments of science of science: many descriptive studies have revealed the strong correlation between scientific research structure and successful results, but the degree to which a specific structure "leads" to the results has not been explored-we don’t know the causality behind the correlation.

By establishing closer cooperation with researchers, scientology will be able to better identify the connections found from models and large-scale data, which have the potential to promote the birth of relevant policies. But the experiment of scientology may be the biggest challenge that scientology has not yet faced. Running randomized controlled trials will change the research process of individuals or scientific institutions supported by taxes, and such a high cost will inevitably lead to criticism and obstacles (87).

Therefore, in the near future, quasi-experimental approaches will be dominant in scientific investigation.

Most scientific research takes scientific research literature as the main data source, which means that the research objects of this discipline are those successful cases. However, most scientific research has failed, sometimes even a huge failure. In view of the fact that scientists fail more than they succeed, it is very important to understand when, where, why and how ideas fail. These studies can provide meaningful guidance for the recurring crisis and help us solve the file drawer problem. By revealing creative activities, these studies can also greatly promote the interpretation of human creativity.

Similar to the economic system, the scientific system is an economic system that uses one-dimensional "currency" quotations. This implies that classes also exist in the scientific research system, in which "the richer the rich" inhibits the spread of new ideas, especially those new scientists and those who do not conform to the traditional identity in a specific field.

The scientific system can be improved by expanding the number and scope of performance indicators. In this regard, it is very important to develop alternative indicators to measure the metrics covering web )(88), social media (89) activity and social impact (90). Other measurable dimensions include information (such as data) shared by scientists and competitors (91), the help they provide to their peers (92), and their reliability as peer reviewers (93).

However, due to the need for a large number of indicators, more work needs to be done to understand the role of each indicator and what it does not capture, so as to ensure meaningful interpretation and avoid abuse. Science of science can make various contributions by providing models, which can deeply understand the coverage of scientific performance indicators and the mechanism behind them. For example, the empirical model observed when using alternative indicators (for example, the distribution of document downloads) will enable us to explore their relationship with the measurement system based on the number of citations (94) and identify black-box operations.

Combining the index based on the number of citations with other indexes will promote the diversified development of scientific research and realize the division of scientific research productivity, so scientists can achieve achievements in different ways. Science is an ecosystem, which needs not only publication, but also disseminators, teachers and experts who pay attention to details. We need people who can ask novel and innovative questions and who can answer them. If curiosity, creativity and knowledge can be effectively exchanged-especially information about the application and social impact of science and technology-more diversified methods can reduce duplication and science can flourish (95).

One problem that science of science tries to solve is the allocation of scientific funds. The current peer review system is biased and contradictory (96). Several alternatives have been proposed, such as random allocation of funds (97), professionals-oriented funds (31) that do not involve proposal and review system, review mechanism (98) that is open to online people, review mechanism (99) that removes reviewers’ performance, and scientist crowdfunding (100) funds.

A key field of future research of SciSci is the integration with machine learning and artificial intelligence, so that objective machines can work with human beings. These new tools will have a pleasant far-reaching, because machines may broaden the horizons of scientists more than human collaborators. For example, self-driving vehicle is a machine learning technology, which is a successful combination of known driving technology and unknown driving habit information. The study of mind-machine partnership has provided a wide range of positive effects on decision-making in a wide range of fields such as health, economy, society and law (101-103). How to improve science through the relationship between machine and mind, and how to arrange it to make scientific development more effective? These questions help us to understand the future science.

references

1. E. Garfield, Citation indexes for science; a new dimension in documentation through association of ideas. Science 122, 108–111 (1955). doi: 10.1126/science.122.3159.108;

pmid: 14385826

2. D. J. S. Price, Little Science, Big Science (Columbia Univ. Press, 1963).

3. J. G. Foster, A. Rzhetsky, J. A. Evans, Tradition and innovation in scientists’ research strategies. Am. Sociol. Rev. 80, –908 (2015). 875doi: 10.1177/

0003122415601618

4. S. Milojevi?, Quantifying the cognitive extent of science. J. Informetr. 9, 962–973 (2015). doi: 10.1016/j.joi.2015.10.005

5. T. Kuhn, M. Perc, D. Helbing, Inheritance patterns in citation networks reveal scientific memes. Phys. Rev. X 4, 041036 (2014). doi: 10.1103/PhysRevX.4.041036

6. R. Klavans, K. W. Boyack, Which type of citation analysis generates the most accurate taxonomy of scientific and technical knowledge? J. Assoc. Inf. Sci. Technol. 68, 984–998 (2016). doi: 10.1002/asi.23734

7. U. Shwed, P. S. Bearman, The temporal structure of scientific consensus formation. Am. Sociol. Rev. 75, 817–840 (2010). doi: 10.1177/0003122410388488; pmid: 21886269

8. J. Bruggeman, V. A. Traag, J. Uitermark, Detecting communities through network data. Am. Sociol. Rev. 77, 1050–1063 (2012). doi: 10.1177/0003122412463574

9. F. Shi, J. G. Foster, J. A. Evans, Weaving the fabric of science:

Dynamic network models of science’s unfolding structure. Soc. Networks 43, 73–85 (2015). doi: 10.1016/j.socnet.2015.02.006

10. L. M. A. Bettencourt, D. I. Kaiser, J. Kaur, Scientific discovery and topological transitions in collaboration networks. J. Informetr. 3, 210–221 (2009). doi: 10.1016/

j.joi.2009.03.001

11. X. Sun, J. Kaur, S. Milojevi?, A. Flammini, F. Menczer, Social dynamics of science. Sci. Rep. 3, 1069 (2013). doi: 10.1038/srep01069; pmid: 23323212

12. T. S. Kuhn, The Essential Tension: Selected Studies in Scientific Tradition and Change (Univ. of Chicago Press, 1977).

13. P. Bourdieu, The specificity of the scientific field and the social conditions of the progress of reasons. Soc. Sci. Inf. (Paris) 14, 19–47 (1975). doi: 10.1177/

053901847501400602

14. T. Jia, D. Wang, B. K. Szymanski, Quantifying patterns of research-interest evolution. Nat. Hum. Behav. 1, 0078 (2017).doi: 10.1038/s41562-017-0078

15. A. Rzhetsky, J. G. Foster, I. T. Foster, J. A. Evans, Choosing experiments to accelerate collective discovery. Proc. Natl. Acad. Sci. U.S.A. 112, 14569–14574 (2015).

doi: 10.1073/pnas.1509757112; pmid: 26554009

16. R. Rosenthal, The file drawer problem and tolerance for null results. Psychol. Bull. 86, 638–641 (1979). doi: 10.1037/0033-2909.86.3.638

17. S. B. Nissen, T. Magidson, K. Gross, C. T. Bergstrom, Publication bias and the canonization of false facts. eLife 5, e21451 (2016). doi: 10.7554/eLife.21451; pmid: 27995896

18. L. Yao, Y. Li, S. Ghosh, J. A. Evans, A. Rzhetsky, Health ROI as a measure of misalignment of biomedical needs and resources. Nat. Biotechnol. 33, 807–811 (2015). doi: 10.1038/nbt.3276; pmid: 26252133

19. C. S. Wagner et al., Approaches to understanding and measuring interdisciplinary scientific research (IDR): A review of the literature. J. Informetr. 5, 14–26 (2011). doi: 10.1016/j.joi.2010.06.004

20. V. Larivière, S. Haustein, K. B?rner, Long-distance interdisciplinarity leads to higher scientific impact. PLOS ONE 10, e0122565 (2015). doi: 10.1371/journal.pone.0122565; pmid: 25822658

21. K. J. Boudreau, E. C. Guinan, K. R. Lakhani, C. Riedl, Looking across and looking beyond the knowledge frontier:

Intellectual distance, novelty, and resource allocation in science. Manage. Sci. 62, 2765–2783 (2016). doi: 10.1287/mnsc.2015.2285; pmid: 27746512

22. E. Leahey, J. Moody, Sociological innovation through subfield

integration. Soc. Currents 1, 228–256 (2014). doi: 10.1177/2329496514540131

23. A. Yegros-Yegros, I. Rafols, P. D’Este, Does interdisciplinary

research lead to higher citation impact? The different effect of proximal and distal interdisciplinarity. PLOS ONE 10, e0135095 (2015). doi:10.1371/journal.pone.0135095; pmid: 26266805

24. L. Bromham, R. Dinnage, X. Hua, Interdisciplinary research has consistently lower funding success. Nature 534, 684–687 (2016). doi: 10.1038/nature18315; pmid: 27357795

25. D. Kim, D. B. Cerigo, H. Jeong, H. Youn, Technological novelty profile and inventions future impact. EPJ Data Sci. 5, 8 (2016). doi: 10.1140/epjds/s13688-016-0069-1

26. B. Uzzi, S. Mukherjee, M. Stringer, B. Jones, Atypical combinations and scientific impact. Science 342, 468–472 (2013). doi: 10.1126/science.1240474; pmid: 24159044

27. J. Wang, R. Veugelers, P. Stephan, “Bias against novelty in science: A cautionary tale for users of bibliometric indicators” (NBER Working Paper No. 22180, National Bureau of Economic Research, 2016).

28. J. P. Walsh, Y.-N. Lee, The bureaucratization of science. Res. Policy 44, 1584–1600 (2015). doi: 10.1016/j.respol.2015.04.010

29. A. M. Petersen, M. Riccaboni, H. E. Stanley, F. Pammolli, Persistence and uncertainty in the academic career.Proc. Natl. Acad. Sci. U.S.A. 109, 5213–5218 (2012). doi: 10.1073/pnas.1121429109; pmid: 22431620

30. P. E. Stephan, How Economics Shapes Science (Harvard Univ.

Press, 2012).

31. P. Azoulay, J. S. Graff Zivin, G. Manso, Incentives and creativity: Evidence from the academic life sciences. Rand J. Econ. 42, 527–554 (2011). doi: 10.1111/

j.1756-2171.2011.00140.x

32. R. Freeman, E. Weinstein, E. Marincola, J. Rosenbaum, F. Solomon, Competition and careers in biosciences. Science

294, 2293–2294 (2001). doi: 10.1126/science.1067477; pmid: 11743184

33. J. A. Evans, J. G. Foster, Metaknowledge. Science 331, 721–725 (2011). doi: 10.1126/science.1201765; pmid: 21311014

34. V. Larivière, C. Ni, Y. Gingras, B. Cronin, C. R. Sugimoto, Bibliometrics: Global gender disparities in science. Nature 504, 211–213 (2013). doi: 10.1038/504211a;

pmid: 24350369

35. S. F. Way, D. B. Larremore, A. Clauset, in Proceedings of the 25th International Conference on World Wide Web (WWW ‘16) (ACM, 2016), pp. 1169–1179.

36. J. Duch et al., The possible role of resource requirements and academic career-choice risk on gender differences in publication rate and impact. PLOS ONE 7, e51332 (2012). doi: 10.1371/journal.pone.0051332; pmid: 23251502

37. J. D. West, J. Jacquet, M. M. King, S. J. Correll, C. T. Bergstrom, The role of gender in scholarly authorship. PLOS ONE 8, e66212 (2013). doi: 10.1371/journal.pone.0066212; pmid: 23894278

38. X. H. T. Zeng et al., Differences in collaboration patterns across discipline, career stage, and gender. PLOS Biol. 14, e1002573 (2016). doi: 10.1371/journal.pbio.1002573; pmid: 27814355

39. T. J. Ley, B. H. Hamilton, The gender gap in NIH grant applications. Science 322, 1472–1474 (2008). doi: 10.1126/ science.1165878; pmid: 19056961

40. C. A. Moss-Racusin, J. F. Dovidio, V. L. Brescoll, M. J. Graham, J. Handelsman, Science faculty’s subtle gender biases favor male students. Proc. Natl. Acad. Sci. U.S.A. 109, 16474–16479

(2012). doi: 10.1073/pnas.1211286109; pmid: 22988126

41. R. Van Noorden, Global mobility: Science on the move. Nature 490, 326–329 (2012). doi: 10.1038/490326a; pmid: 23075963

42. O. A. Doria Arrieta, F. Pammolli, A. M. Petersen, Quantifying

the negative impact of brain drain on the integration of European science. Sci. Adv. 3, e1602232 (2017). doi: 10.1126/

sciadv.1602232; pmid: 28439544

43. C. Franzoni, G. Scellato, P. Stephan, The mover’s advantage: The superior performance of migrant scientists. Econ. Lett. 122, 89–93 (2014). doi: 10.1016/j.econlet.2013.10.040

44. C. R. Sugimoto et al., Scientists have most impact when they’re free to move. Nature 550, 29–31 (2017). doi: 10.1038/550029a; pmid: 28980663

45. A. Clauset, S. Arbesman, D. B. Larremore, Systematic inequality and hierarchy in faculty hiring networks. Sci. Adv.1, e1400005 (2015). doi: 10.1126/sciadv.1400005; pmid: 26601125

46. P. Deville et al., Career on the move: Geography, stratification, and scientific impact. Sci. Rep. 4, 4770 (2014). pmid: 24759743

47. A. M. Petersen et al., Reputation and impact in academic careers. Proc. Natl. Acad. Sci. U.S.A. 111, 15316–15321 (2014). doi: 10.1073/pnas.1323111111; pmid: 25288774

48. D. K. Simonton, Creative productivity: A predictive and explanatory model of career trajectories and landmarks. Psychol. Rev. 104, 66–89 (1997). doi: 10.1037/

0033-295X.104.1.66

49. R. Sinatra, D. Wang, P. Deville, C. Song, A.-L. Barabási, Quantifying the evolution of individual scientific impact. Science 354, aaf5239 (2016). doi: 10.1126/science.aaf5239; pmid: 27811240

50. S. Wuchty, B. F. Jones, B. Uzzi, The increasing dominance of teams in production of knowledge. Science 316, 1036–1039 (2007). doi: 10.1126/science.1136099; pmid: 17431139

51. N. J. Cooke, M. L. Hilton, Eds., Enhancing the Effectiveness of Team Science (National Academies Press, 2015).

52. V. Larivière, Y. Gingras, C. R. Sugimoto, A. Tsou, Team size matters: Collaboration and scientific impact since 1900. J. Assoc. Inf. Sci. Technol. 66, 1323–1332 (2015).

doi: 10.1002/asi.23266

53. L. Wu, D. Wang, J. A. Evans, Large teams have developed science and technology; small teams have disrupted it. arXiv:1709.02445 [physics.soc-ph] (7 September 2017).

54. B. F. Jones, The burden of knowledge and the “death of the renaissance man”: Is innovation getting harder? Rev. Econ. Stud. 76, 283–317 (2009). doi: 10.1111/j.1467-937X.2008.00531.x

55. S. Milojevi?, Principles of scientific research team formation and evolution. Proc. Natl. Acad. Sci. U.S.A. 111, 3984–3989 (2014). doi: 10.1073/pnas.1309723111; pmid: 24591626

56. G. Palla, A.-L. Barabási, T. Vicsek, Quantifying social group evolution. Nature 446, 664–667 (2007). doi: 10.1038/nature05670; pmid: 17410175

57. G. J. Borjas, K. B. Doran, Which peers matter? The relative impacts of collaborators, colleagues, and competitors. Rev. Econ. Stat. 97, 1104–1117 (2015). doi: 10.1162/REST_a_00472

58. P. Azoulay, J. G. Zivin, J. Wang, Superstar extinction. Q. J. Econ. 125, 549–589 (2010). doi: 10.1162/qjec.2010.125.2.549

59. A. M. Petersen, Quantifying the impact of weak, strong, and super ties in scientific careers. Proc. Natl. Acad. Sci. U.S.A. 112, E4671–E4680 (2015). doi: 10.1073/pnas.1501444112; pmid: 26261301

60. R. K. Merton, The Matthew effect in science. Science 159, 56–63 (1968). doi: 10.1126/science.159.3810.56

61. L. Allen, J. Scott, A. Brand, M. Hlava, M. Altman, Publishing: Credit where credit is due. Nature 508, 312–313 (2014). doi: 10.1038/508312a; pmid: 24745070

62. H.-W. Shen, A.-L. Barabási, Collective credit allocation in science. Proc. Natl. Acad. Sci. U.S.A. 111, 12325–12330 (2014). doi: 10.1073/pnas.1401992111; pmid: 25114238

63. L. Waltman, A review of the literature on citation impact indicators. J. Informetr. 10, 365–391 (2016). doi: 10.1016/j.joi.2016.02.007

64. J. E. Hirsch, An index to quantify an individual’s scientific

research output. Proc. Natl. Acad. Sci. U.S.A. 102, 16569–16572 (2005). doi: 10.1073/pnas.0507655102; pmid: 16275915

65. H. F. Moed, Citation Analysis in Research Evaluation (Springer, 2010).

66. E. Garfield, Citation analysis as a tool in journal evaluation.

Science 178, 471–479 (1972). doi: 10.1126/science.178.4060.471; pmid: 5079701

67. D. J. de Solla Price, Networks of scientific papers. Science

149, 510–515 (1965). doi: 10.1126/science.149.3683.510; pmid: 14325149

68. Q. Zhang, N. Perra, B. Gon?alves, F. Ciulla, A. Vespignani,

Characterizing scientific production and consumption in physics. Sci. Rep. 3, 1640 (2013). doi: 10.1038/srep01640; pmid: 23571320

69. F. Radicchi, S. Fortunato, C. Castellano, Universality of citation distributions: Toward an objective measure of scientific impact. Proc. Natl. Acad. Sci. U.S.A. 105,

17268–17272 (2008). doi: 10.1073/pnas.0806977105;

pmid: 18978030

70. L. Waltman, N. J. van Eck, A. F. J. van Raan, Universality of citation distributions revisited. J. Assoc. Inf. Sci. Technol. 63, 72–77 (2012). doi: 10.1002/asi.21671

71. M. Golosovsky, S. Solomon, Runaway events dominate the heavy tail of citation distributions. Eur. Phys. J. Spec. Top. 205, 303–311 (2012). doi: 10.1140/epjst/e2012-01576-4

72. C. Stegehuis, N. Litvak, L. Waltman, Predicting the long-term citation impact of recent publications. J. Informetr. 9, 642–657 (2015). doi: 10.1016/j.joi.2015.06.005

73. M. Thelwall, The discretised lognormal and hooked power law distributions for complete citation data: Best options for modelling and regression. J. Informetr. 10, 336–346 (2016). doi: 10.1016/j.joi.2015.12.007

74. D. de Solla Price, A general theory of bibliometric and other cumulative advantage processes. J. Am. Soc. Inf. Sci. 27, 292–306 (1976). doi: 10.1002/asi.4630270505

75. A.-L. Barabási, R. Albert, Emergence of scaling in random networks. Science 286, 509–512 (1999). doi: 10.1126/science.286.5439.509; pmid: 10521342

76. P. D. B. Parolo et al., Attention decay in science. J. Informetr. 9, 734–745 (2015). doi: 10.1016/j.joi.2015.07.006

77. D. Wang, C. Song, A.-L. Barabási, Quantifying long-term scientific impact. Science 342, 127–132 (2013). doi: 10.1126/science.1237825; pmid: 24092745

78. Y.-H. Eom, S. Fortunato, Characterizing and modeling citation dynamics. PLOS ONE 6, e24926 (2011). doi: 10.1371/journal.pone.0024926; pmid: 21966387

79. M. Golosovsky, S. Solomon, Stochastic dynamical model of a growing citation network based on a self-exciting point process. Phys. Rev. Lett. 109, 098701 (2012). doi: 10.1103/PhysRevLett.109.098701; pmid: 23002894

80. A. F. J. van Raan, Sleeping Beauties in science. Scientometrics 59, 467–472 (2004). doi: 10.1023/B:SCIE.0000018543.82441.f1

81. Q. Ke, E. Ferrara, F. Radicchi, A. Flammini, Defining and

identifying Sleeping Beauties in science. Proc. Natl. Acad. Sci. U.S.A. 112, 7426–7431 (2015). doi: 10.1073/pnas.1424329112; pmid: 26015563

82. I. Tahamtan, A. Safipour Afshar, K. Ahamdzadeh, Factors affecting number of citations: A comprehensive review of the literature. Scientometrics 107, 1195–1225 (2016). doi: 10.1007/s11192-016-1889-2

83. J. E. Hirsch, Does the h index have predictive power? Proc. Natl. Acad. Sci. U.S.A. 104, 19193–19198 (2007). doi: 10.1073/pnas.0707962104; pmid: 18040045

84. D. E. Acuna, S. Allesina, K. P. Kording, Future impact: Predicting scientific success. Nature 489, 201–202 (2012). doi: 10.1038/489201a; pmid: 22972278

85. O. Penner, R. K. Pan, A. M. Petersen, K. Kaski, S. Fortunato, On the predictability of future impact in science. Sci. Rep. 3, 3052 (2013). doi: 10.1038/srep03052; pmid: 24165898

86. J. R. Cole, H. Zuckerman, in The Idea of Social Structure: Papers in Honor of Robert K. Merton, L. A. Coser, Ed. (Harcourt Brace Jovanovich, 1975), pp. 139–174.

87. P. Azoulay, Research efficiency: Turn the scientific method on

ourselves. Nature 484, 31–32 (2012). doi: 10.1038/484031a;

pmid: 22481340

88. M. Thelwall, K. Kousha, Web indicators for research evaluation. Part 1: Citations and links to academic articles from the Web. Prof. Inf. 24, 587–606 (2015). doi: 10.3145/epi.2015.sep.08

89. M. Thelwall, K. Kousha, Web indicators for research evaluation. Part 2: Social media metrics. Prof. Inf. 24, 607–620 (2015). doi: 10.3145/epi.2015.sep.09

90. L. Bornmann, What is societal impact of research and how can it be assessed? A literature survey. Adv. Inf. Sci. 64, 217–233 (2013).

91. C. Haeussler, L. Jiang, J. Thursby, M. Thursby, Specific and general information sharing among competing academic researchers. Res. Policy 43, 465–475 (2014). doi: 10.1016/j.respol.2013.08.017

92. A. Oettl, Sociology: Honour the helpful. Nature 489, 496–497(2012). doi: 10.1038/489496a; pmid: 23018949

93. S. Ravindran, “Getting credit for peer review,” Science, 8 February 2016; www.sciencemag.org/careers/2016/02/getting-credit-peer-review.

94. R. Costas, Z. Zahedi, P. Wouters, Do “altmetrics” correlate with citations? Extensive comparison of altmetric indicators with citations from a multidisciplinary perspective. J. Assoc. Inf. Sci. Technol. 66, 2003–2019 (2015). doi: 10.1002/asi.23309

75. A.-L. Barabási, R. Albert, Emergence of scaling in random networks. Science 286, 509–512 (1999). doi: 10.1126/science.286.5439.509; pmid: 10521342

76. P. D. B. Parolo et al., Attention decay in science. J. Informetr. 9, 734–745 (2015). doi: 10.1016/j.joi.2015.07.006

77. D. Wang, C. Song, A.-L. Barabási, Quantifying long-term scientific impact. Science 342, 127–132 (2013). doi: 10.1126/science.1237825; pmid: 24092745

78. Y.-H. Eom, S. Fortunato, Characterizing and modeling citation dynamics. PLOS ONE 6, e24926 (2011). doi: 10.1371/journal.pone.0024926; pmid: 21966387

79. M. Golosovsky, S. Solomon, Stochastic dynamical model of a growing citation network based on a self-exciting point process. Phys. Rev. Lett. 109, 098701 (2012). doi: 10.1103/PhysRevLett.109.098701; pmid: 23002894

80. A. F. J. van Raan, Sleeping Beauties in science. Scientometrics 59, 467–472 (2004). doi: 10.1023/B:SCIE.0000018543.82441.f1

81. Q. Ke, E. Ferrara, F. Radicchi, A. Flammini, Defining and identifying Sleeping Beauties in science. Proc. Natl. Acad. Sci. U.S.A. 112, 7426–7431 (2015). doi: 10.1073/pnas.1424329112; pmid: 26015563

82. I. Tahamtan, A. Safipour Afshar, K. Ahamdzadeh, Factors affecting number of citations: A comprehensive review of the literature. Scientometrics 107, 1195–1225 (2016). doi: 10.1007/s11192-016-1889-2

83. J. E. Hirsch, Does the h index have predictive power? Proc. Natl. Acad. Sci. U.S.A. 104, 19193–19198 (2007). doi: 10.1073/pnas.0707962104; pmid: 18040045

84. D. E. Acuna, S. Allesina, K. P. Kording, Future impact: Predicting scientific success. Nature 489, 201–202 (2012). doi: 10.1038/489201a; pmid: 22972278

85. O. Penner, R. K. Pan, A. M. Petersen, K. Kaski, S. Fortunato, On the predictability of future impact in science. Sci. Rep. 3, 3052 (2013). doi: 10.1038/srep03052;

pmid: 24165898

86. J. R. Cole, H. Zuckerman, in The Idea of Social Structure: Papers in Honor of Robert K. Merton, L. A. Coser, Ed. (Harcourt Brace Jovanovich, 1975), pp. 139–174.

87. P. Azoulay, Research efficiency: Turn the scientific method on ourselves. Nature 484, 31–32 (2012). doi: 10.1038/484031a; pmid: 22481340

88. M. Thelwall, K. Kousha, Web indicators for research evaluation. Part 1: Citations and links to academic articles from the Web. Prof. Inf. 24, 587–606 (2015). doi: 10.3145/epi.2015.sep.08

89. M. Thelwall, K. Kousha, Web indicators for research evaluation. Part 2: Social media metrics. Prof. Inf. 24, 607–620 (2015). doi: 10.3145/epi.2015.sep.09

90. L. Bornmann, What is societal impact of research and how can it be assessed? A literature survey. Adv. Inf. Sci. 64, 217–233 (2013).

91. C. Haeussler, L. Jiang, J. Thursby, M. Thursby, Specific and general information sharing among competing academic researchers. Res. Policy 43, 465–475 (2014). doi: 10.1016/j.respol.2013.08.017

92. A. Oettl, Sociology: Honour the helpful. Nature 489, 496–497 (2012). doi: 10.1038/489496a; pmid: 23018949

93. S. Ravindran, “Getting credit for peer review,” Science, 8

February 2016; www.sciencemag.org/careers/2016/02/

getting-credit-peer-review.

94. R. Costas, Z. Zahedi, P. Wouters, Do “altmetrics” correlate with citations? Extensive comparison of altmetric indicators with citations from a multidisciplinary perspective. J. Assoc. Inf. Sci. Technol. 66, 2003–2019 (2015). doi: 10.1002/asi.23309

Compilation: Translation Group of Jizhi Club

Source: science

Original title: science of science

Original address:

https://science.sciencemag.org/content/359/6379/eaao0185

Original title: "A Summary of Science Long Articles: What is Science of Science | New Year Special"

Read the original text