On the Times Value of Revolutionary Culture

Author: Pan Hong (researcher, Institute of Military Political Work, Academy of Military Sciences)

"Revolutionary culture" is a special cultural phenomenon, and people from all walks of life in China interpret, publicize and practice it with their own understanding of its connotation. In many parts of China, revolutionary culture is more often called "red culture". As a result, "revolutionary culture" and "red culture" are confused, the original intention of revolutionary culture is diluted, and the explanation of red culture is more "different". After careful analysis, it is found that the concept of "red culture" appeared at the beginning of the 21st century. After more than 20 years of reform and opening up, China faces many difficulties in its development. It is inevitable that people will recall the faith and spiritual strength that led the party and people to victory from the past history and experience. Facts have proved that this phenomenon is very consistent with the cultural records of academic circles at that time. The full-text database of China journals shows that in 2003— In the academic papers in 2004, "red culture" has become the key word. At the same time, some scholars have noticed that before the concept of red culture appeared, the academic circles in China had already put forward such terms as "red classics", "red resources" and "red tourism". Are these formulations accurate?Should the inheritance of revolutionary tradition return to its original intention? In the new era of Socialism with Chinese characteristics, it has become an important concern for people to find a correct position for revolutionary culture and reflect its contemporary value.

The fundamental difference between revolutionary culture and other cultures lies in the red background color paved by the China Revolution.

The report of the 19th National Congress of the Communist Party of China pointed out that culture is the soul of a country and a nation. "Socialism with Chinese characteristics culture, which originated from the excellent traditional Chinese culture nurtured by the 5,000-year civilization history of the Chinese nation, was cast in the revolutionary culture and advanced socialist culture created by the party leading the people in revolution, construction and reform, and was rooted in the great practice of Socialism with Chinese characteristics". It can be seen from this document that condenses the latest theoretical achievements of the Party that "red culture" should be called "revolutionary culture" in a standardized way, and its historical origin can be traced back to the magnificent new-democratic revolutionary practice in China in the early 20th century.

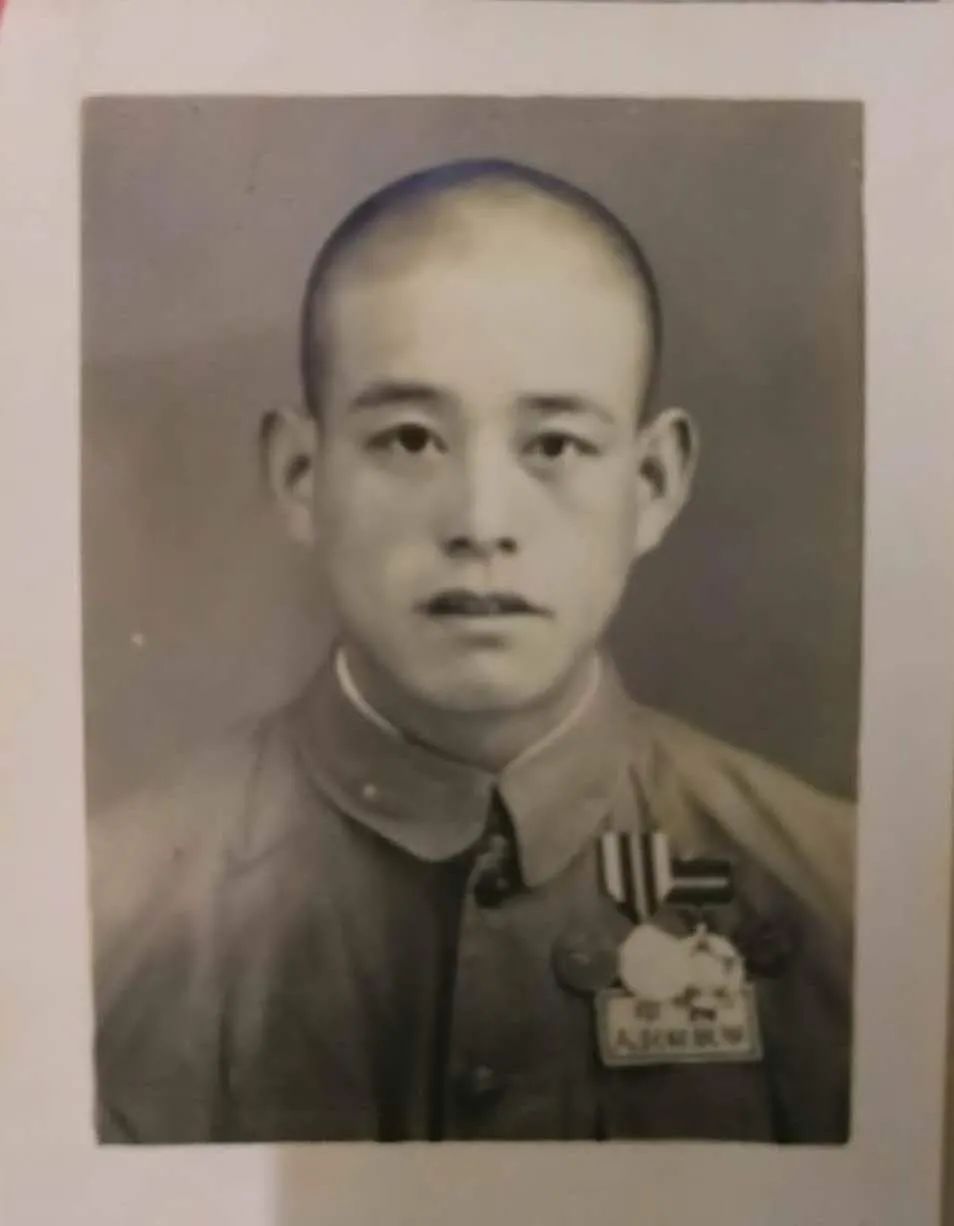

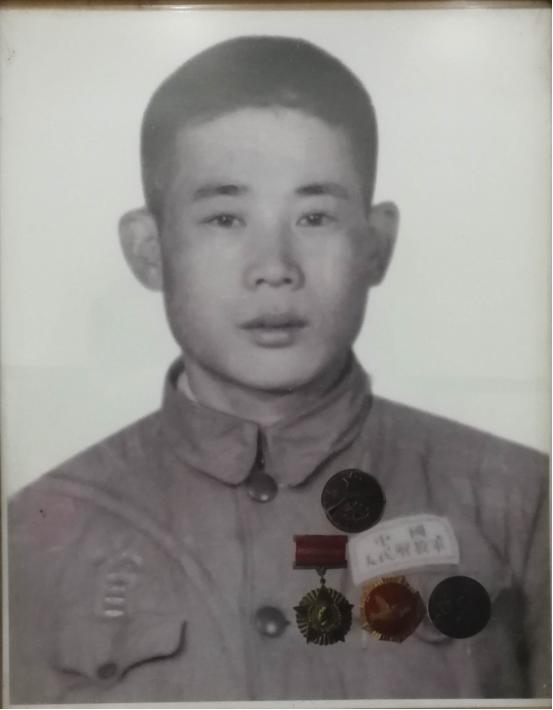

China’s "revolutionary culture" can be traced back to the founding of the Communist Party of China (CPC), and it is closely related to the establishment of proletarian political parties in the world and Marxist theory. In the mid-19th century, after the birth of Marxism in Europe, after half a century, it changed from a ghost to a proletarian revolutionary theory, which guided the success of the October Revolution in the Soviet Union and showed the future direction of the China Revolution with the light of truth. As a result, in the 20th century, China in the East kept switching revolutionary themes in the democratic revolution, national salvation and people’s liberation movements. In the mutual agitation and choice of various ideologies and plans to save China, the Communist Party of China (CPC) wrote Marxist theory on his banner, led the people in unremitting struggle and made great sacrifices to realize the lofty ideal of communism. According to the statistics of the Information Center of the Academy of Military Sciences, during the 22 years from 1927 to 1949, there were 3,203 major battles and battles that were able to find out the basic elements such as battle names, combat areas, our troops participating in the war, enemy troops participating in the war, and combat results. "I dare to teach the sun and the moon to change the sky for the sake of sacrifice and ambition." Under the leadership of the Communist Party of China, the people’s army finally seized power and established People’s Republic of China (PRC) after arduous struggle. Deng Xiaoping once said that the founding of New China was dyed red with the blood of hundreds of millions of martyrs. Indeed, the blood of the revolutionary martyrs paved the background of the China revolution, and only then did the red China in the eyes of foreigners have the red regime in Chinese’s heart, and today ".红色文化”称谓的流传。

中国共产党及其领导下的人民军队是革命文化的主创者。1927年第一次国共合作破裂后,面对国民党的屠杀政策,中国共产党为挽救革命,实行武装抵抗。在著名的三大起义中,南昌起义部队沿用了国民革命军的番号;秋收起义非常接地气地打出了“工农革命军”的人民武装旗号,广州起义因有苏联顾问的参与指导,宣布组织“工农红军”,并打出了“工农红军”旗帜。当时中国共产党作为共产国际远东支部,无条件接受其领导,中共中央遂于1928年5月25日发布《军事工作大纲》,明确规定武装“割据区所建立之军队,可正式定名为红军,取消以前工农革命军的名义”。井冈山上的毛泽东、朱德根据中央指示,将工农革命军第四军正式改称“中国工农红军第四军”,各革命根据地武装力量先后奉命改称“红军”。1931年后,全国各地革命军队统一改称“中国工农红军。”1936年,红军长征的胜利,使中国工农红军的红色传奇故事走向世界。

Under the leadership of the Communist Party of China (CPC), this red powerhouse developed from a single spark to a prairie fire during the Agrarian Revolution. During the War of Resistance against Japanese Aggression period, he resolutely went to the battlefield behind enemy lines to carry out independent guerrilla warfare and joined hands with the Kuomintang to resist aggression and win national liberation; In the war of liberation, we fought a strategic decisive battle with the Kuomintang for the two futures and destinies of the people of China; Finally, after 28 years of bloody fighting, he completed the task of the new democratic revolution, established the proletarian regime, and became a strong pillar of the new socialist China.

Thus, the background color of China Revolution is red, and the banner of China Revolution is also dyed red with the blood of millions of martyrs. Needless to say, the dictatorship of the proletariat and its theory of violent revolution have transformed semi-colonial and semi-feudal China in China, and the people have become masters of their own affairs. The essence of all this is the practice of China’s new-democratic revolution. Therefore, any "colored" cultural term can reflect this practice process more accurately than "revolutionary culture".

After the 18th National Congress of the Communist Party of China, General Secretary of the Supreme Leader attached great importance to the inheritance and construction of revolutionary culture. During his inspection of the former Lanzhou Military Region, he stressed that it is necessary to carry forward the advantages of red resources, carry out in-depth education on the military history of party history and fine traditions, and pass on the red gene from generation to generation. Since then, he has visited Xibaipo, Jinggangshan, Yimeng Mountain, Gutian, Yan ‘an, Zunyi and other revolutionary holy places. After the 19th National Congress of the Communist Party of China, General Secretary of the Supreme Leader led The Politburo Standing Committee (PSC), paid a visit to the site of the First Congress of the Communist Party of China in Shanghai and the Red Boat in Nanhu, Jiaxing, Zhejiang, reviewed the history of party building and revisited the pledge of joining the Party, in which the "revolutionary main line" was clearly visible. To be exact, red is only a symbolic meaning, but revolutionary culture is the "root" and "soul" of the Communist Party of China (CPC)’s national rejuvenation in the new era, so that we can deeply understand the original intention of "keeping in mind the original heart" and never forget "knowing where to go from where to go".

Following the main line of the Supreme Leader’s visit to the revolutionary holy land, the rich connotation of revolutionary culture has been gradually revealed. The Jinggangshan struggle made us understand the inevitability of ideological vacillation at the beginning of the revolution and the importance of strengthening the confidence in the victory of the revolution. At Gutian Conference, the Party stipulated the nature, purpose and task of the Red Army in the form of resolutions, and made clear the basic problem of "who carries guns and fights for whom". Established the principle of the party’s absolute leadership over the army and solved the fundamental problem of how the party leads the army; Straightened out the relationship between military work and political work in the army, and the basic way to correct all kinds of non-proletarian thoughts. The Zunyi Meeting marked that the China Revolution got rid of dogmatism, the Communist Party of China (CPC) began to explore the China Revolution independently, and the China style and China style at the beginning of the formation of Mao Zedong Thought. Yan’ an years make people feel the hardships during the anti-Japanese national salvation period and the richness in the spiritual world of the revolutionary holy land; Xibaipo — — The Central Committee of the Communist Party of China, the last rural headquarters of China Revolution, issued an earnest warning to all party member before going to the ruling stage. In this way, the connotation of revolutionary culture should include: rich contents of material and intangible culture as revolutionary cultural resources; All the old things and relics, former sites and sites related to the revolutionary struggle and other revolutionary historical remains and memorial sites,And the corresponding revolutionary spirits formed in the revolutionary years, including Red Boat Spirit, Jinggangshan Spirit, Long March Spirit, Yan ‘an Spirit, Xibaipo Spirit and so on.

Revolutionary culture was formed in the great practice of China revolution and has distinct spiritual characteristics.

Revolutionary culture was conceived in the Communist Party of China (CPC)’s initial intention of seeking happiness for the people of China and rejuvenation for the Chinese nation, and formed in the great practice of the China Revolution. It is a precious spiritual wealth of the Chinese nation’s history and culture, and has become a powerful spiritual driving force and cultural support for national rejuvenation. The strong vitality of revolutionary culture is embodied in its distinctive spiritual characteristics.

Revolutionary. It mainly includes the revolutionary theory and the revolutionary practice. Nearly 70 years after the publication of the communist party Declaration, Marxist theory has finally changed from revolutionary prophecy to reality. In China’s new-democratic revolution, the Communist Party of China (CPC) people, represented by Mao Zedong, made Marxism take root in China with outstanding theoretical consciousness, practical consciousness and historical consciousness. As the first theoretical achievement of China Marxism, the formation and development of Mao Zedong Thought greatly enriched and developed the treasure house of Marxist theory. Revolutionary culture is the reflection of China’s new-democratic revolutionary struggle, so revolutionary is the proper meaning in the practice of China’s new-democratic struggle.

Nationality. The direct motive of Mao Zedong’s systematic study of Marxism in Yan ‘an caves is to avoid the "Left" and Right-leaning erroneous thoughts in the Communist Party of China (CPC) from harming the Party’s cause again. At the Sixth Plenary Session of the Sixth Central Committee of the Communist Party of China, he stressed: "To make Marx concrete in China and make him have the characteristics of China in every performance, that is, to apply it according to the characteristics of China has become an urgent problem for the whole party to understand and solve." Mao Zedong, who came out of Chongli, Shaoshan, Hunan Province, was a peasant all his life, and became attached to the land, farmers and countryside. He has always been proud of the Chinese nation, eclectically absorbed outstanding achievements of foreign civilization, and achieved the revolutionary cause in China. Mao Zedong’s theoretical innovation has always been based on the Marxist way of thinking, but it has never been a ready-made word in the "book" of Marxism, and it has always reflected the national style that is closest to the reality of China, and China’s revolutionary culture has been marked with a distinctive national brand.

Popular. In the communist party Declaration, Marx solemnly declared: "All the movements in the past were for or for the benefit of a few people. The proletarian movement belongs to the vast majority of people and works for the interests of the vast majority of people. " The people of the Communist Party of China (CPC), represented by Mao Zedong, know the essence of historical materialism, creatively put forward the Party’s mass line, that is, the ideological line of "all for the masses, all relying on the masses, coming from the masses and going to the masses", and reached the conclusion that "the people, only the people, are the driving force for creating world history", which became an important magic weapon for China’s revolutionary victory. The laboring masses in China saw the power of example and the hope of China’s revolution when the advanced revolutionary elements in China put aside their superior lives and devoted themselves to the proletarian movement for the benefit of the vast majority of people, thus making the revolutionary culture a popular feature of the revolutionary movement "for the people".

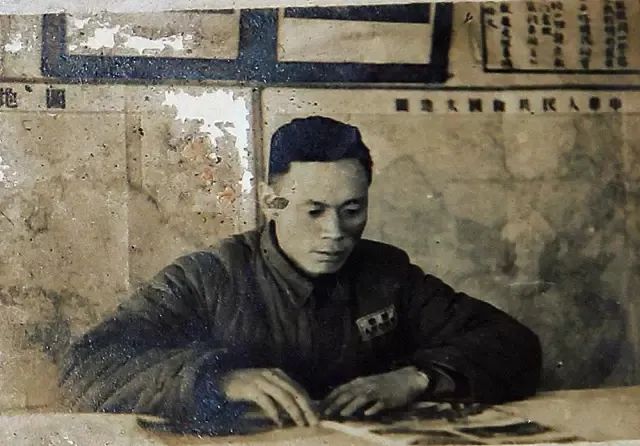

Times. Every era has its own cultural requirements and characteristics, that is, the so-called "fashion". All cultures are created in specific times, so the necessity of any group culture, its creativity and its inheritance and elimination have a distinct brand of the times. Take the Long March as an example, which is a microcosm of the China Revolution. The "fashion" of the China Revolution in the 1930s was: advocating firm faith. The number of people who arrived in northern Shaanxi on the Red Army’s Long March only accounted for 30% of the number at the time of departure. This is undoubtedly a collective "martyr’s ambition" for "ism"! Advocate loyalty to the party. After the Red Army and the Red Fourth Front Army joined forces, Zhang Guotao split the Central Committee, which almost ruined the China Revolution. It was the backbone of the party’s loyalty to safeguard the party’s unity and avoid division; The response and support of the 15th Red Army Corps to the Central Committee of the Communist Party of China and the Central Red Army under the leadership of Mao Zedong in northern Shaanxi made it possible for the Party to lay a political and military foundation in the Shaanxi-Gansu base area. On the Long March, Mao Zedong turned the stretcher into a political stage, showing the mind of revolutionaries in adversity, reflecting a high degree of historical responsibility, regaining leadership, and avoiding the collapse of the Party and the Red Army.

Innovation. Revolutionary culture includes theoretical innovation, institutional innovation and practical innovation. In order to counter the argument that China’s ravines can’t produce Marxism, Mao Zedong wrote On Practice and On Contradiction, which laid the philosophical foundation of Mao Zedong’s dialectical materialism and historical materialism. In 1938 alone, Mao Zedong’s theoretical achievements included Strategic Issues of Anti-Japanese Guerrilla War, On Protracted War, Independence in the United Front and so on. These programmatic documents are full of thoughts on the key issues of China’s revolutionary war. Mao Zedong explained the Marxist view of war and methodology with his unique "dialectics of war". In 1939, Mao Zedong wrote "China Revolution and the Communist Party of China (CPC)", put forward the scientific concept of "new democratic revolution" for the first time, and defined the basic content of the general line of new democracy. In 1940, Mao Zedong wrote "On New Democracy", which planned the new China after military victory and expounded the politics, economy and culture of new democracy. In 1945, Mao Zedong wrote "On the Coalition Government", which designed the revolution after the victory of the Anti-Japanese War, further linked the politics, economy and culture of the new democratic society with the Party’s program, and completed the blueprint for the new China.

The reason why revolutionary culture has vitality stems from its agreement with contemporary spiritual pursuit and values.

The ancients said, "Look at humanity and turn it into the world." The power of culture is the meridian that runs through the historical evolution of human society, and it is the progressive soul of a country and a nation. Revolutionary culture was formed in the period of China’s new-democratic revolution, and it is the product of that era. Besides its own spiritual characteristics, revolutionary culture partially overlaps with contemporary spiritual pursuits and values. Because of this, whenever we walk into any remains of China’s revolutionary culture, we will feel the shock of our hearts, which is one aspect of the contemporary value of revolutionary culture.

In the report of the 19th National Congress of the Communist Party of China, General Secretary of the Supreme Leader pointed out that we should promote the creative transformation and innovative development of Chinese excellent traditional culture, inherit revolutionary culture, develop advanced socialist culture, keep in mind the original, absorb foreign countries and face the future, better build China spirit, China values and Chinese strength, and provide spiritual guidance for the people. In the new era when the Communist Party of China (CPC) leads the people of China to great rejuvenation, revolutionary culture has special times value.

The first is to help the leadership of ideological work. Revolutionary culture continues to promote the China, modernization and popularization of Marxism, laying an important foundation for building a socialist ideology with strong cohesion and leading force, and closely uniting all the people in ideals, beliefs, values and moral concepts, and providing a strong support for strengthening theoretical arms and promoting the supreme leader’s Socialism with Chinese characteristics Thought in the new era to be deeply rooted in the hearts of the people. The relationship between revolutionary culture and Socialism with Chinese characteristics culture in the new era is inseparable: the revolutionary culture is formed in the initial stage of Marxism in China, and it has made great theoretical contributions to Marxism in China. As the latest theoretical achievement of Marxism in China, the Supreme Leader’s New Era Socialism with Chinese characteristics Thought is an important part of Socialism with Chinese characteristics’s theoretical system and a guide for the struggle of the whole party and the people of the whole country to practice the great rejuvenation of the Chinese nation. Theoretically, the two are in the same strain. The essence of Socialism with Chinese characteristics is that it must adhere to the leadership of the Communist Party of China (CPC), and the greatest advantage of the Socialism with Chinese characteristics system is that it has always adhered to the leadership of the Communist Party of China (CPC), which is basically consistent and unshakable. Guided by the latest theoretical achievements of contemporary Marxism in China, leading the country, the nation and the people to achieve the Party’s goals is also the homogeneous requirement of revolutionary culture and Socialism with Chinese characteristics culture in the new era.

The second is to help cultivate and practice socialist core values. The influence of culture is first of all the influence of values. The struggle for various cultures in the world is essentially a struggle for values, as well as a struggle for people’s hearts and ideology. As the saying goes, "the strength of a moment lies in strength, and the victory or defeat of the ages lies in reason." Core values are the spiritual bond that a nation depends on and the common ideological and moral foundation of a country. The important reason why the Chinese nation’s thousands of years of history is endless, handed down from generation to generation and tenacious development is that the Chinese nation has a common spiritual pursuit, spiritual characteristics and spiritual context. What kind of values should China and the Chinese nation adhere to? This is both a theoretical issue and a practical one. The General Secretary of the Supreme Leader pointed out that our socialist core values of prosperity, democracy, civilization, harmony, freedom, equality, justice, rule of law, patriotism, professionalism, honesty and friendliness embody the thoughts of ancient sages, the long-cherished aspirations of people with lofty ideals, the ideals of revolutionary martyrs and the yearning for a better life of people of all ethnic groups. From this, we can understand the common ideological foundation of socialist core values and revolutionary culture.

The third is to help strengthen ideological and moral construction. In the report of the 19th National Congress of the Communist Party of China, General Secretary of the Supreme Leader pointed out that it is necessary to improve people’s ideological consciousness, moral standards and civilized accomplishment, raise the level of civilization of the whole society, extensively carry out education on ideals and beliefs, deepen publicity and education on Socialism with Chinese characteristics and the Chinese dream, carry forward the national spirit and the spirit of the times, strengthen education on patriotism, collectivism and socialism, and guide people to establish a correct view of history, nationality, country and culture. At the Seventh Plenary Session of the 18th Central Commission for Discipline Inspection, the General Secretary of the Supreme Leader emphasized: "If leading cadres want to forget their initial intentions and stick to the right path, they must strengthen their cultural self-confidence. Without the foundation and nourishment of China’s excellent traditional culture, revolutionary culture and advanced socialist culture, it is difficult to be deep and persistent. " Revolutionary spirits cultivated by revolutionary culture in different historical periods, such as Red Boat Spirit, Jinggangshan Spirit, Long March Spirit, Yan ‘an Spirit, Xibaipo Spirit, etc., show patriotic feelings of loyalty and sincere dedication to the country; Not afraid of strong enemies, dare to fight and win; Heroic spirit of overwhelming decisive battle; The spirit of sacrifice that takes death as death and dares to struggle; Loyal and unyielding revolutionary integrity; The psychological strength of being calm and resolute; Military orders, such as mountains, military discipline, such as iron, are all inherent manifestations of revolutionary culture. Revolutionary culture and the national spirit with patriotism as the core emphasized by Socialism with Chinese characteristics culture in the new era have the same value pursuit.

The fourth is to help the prosperity and development of socialist literature and art. Socialist literary and artistic creation comes from the people and takes the people as the center. To prosper literary and artistic creation, we must be rooted in historical themes and realistic themes, and constantly tap and launch masterpieces that eulogize the party, the motherland, the people and the heroes of the era. Advocate stressing taste, style and responsibility, and resist vulgarity, vulgarity and kitsch. Revolutionary culture is the product of the war years, so the spirit of high-spirited struggle is its distinctive feature. At the same time, the simple and colorful literary form of revolutionary culture is popular with the public, so it is also the easiest to take root among the broad masses. This is particularly worth learning and thinking in the new era today, in order to avoid borrowing the name of revolutionary culture and practice vulgar vulgar kitsch culture.

The fifth is to help the development of cultural undertakings and cultural industries. In order to meet people’s new expectation of a better life, we must provide rich spiritual food for the people. Therefore, strengthening the protection and utilization of revolutionary cultural resources must be regarded as an important content to improve the public cultural service system, implement the cultural benefit project and enrich mass cultural activities. We will continue to build international communication capacity and tell the story of China well. We should not only make full use of the brilliant achievements of ancient Chinese civilization, but also deeply explore the spiritual connotation of revolutionary culture, show the world a true, three-dimensional and comprehensive China, and improve the cultural soft power of the country. Protecting and managing Chinese traditional culture and revolutionary culture well, at the same time, strengthening research and utilization, allowing history to speak and cultural relics to speak, while inheriting the achievements and glory of Chinese culture and revolutionary culture, enhancing national pride and self-confidence will surely become the best way to understand history and learn from future development.

Guangming Daily (October 9, 2018, 05 edition)