During the period of Spring Festival travel rush, the search popularity of inter-provincial tourism products increased by 12 times, and many tourism bureaus issued subsidies to avoid tickets and grab

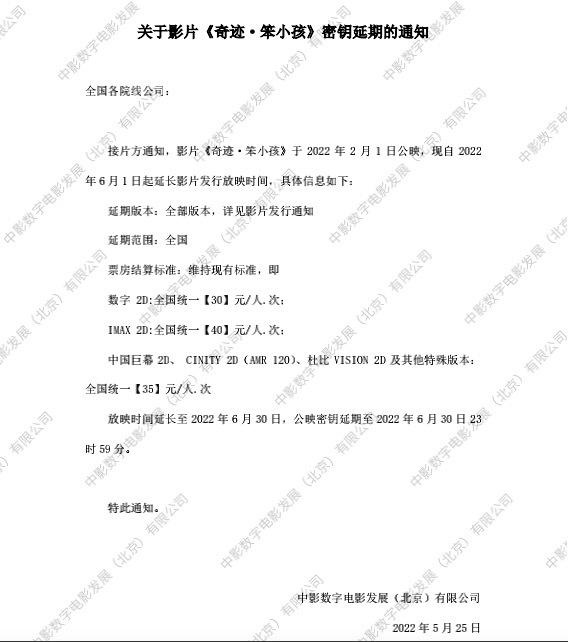

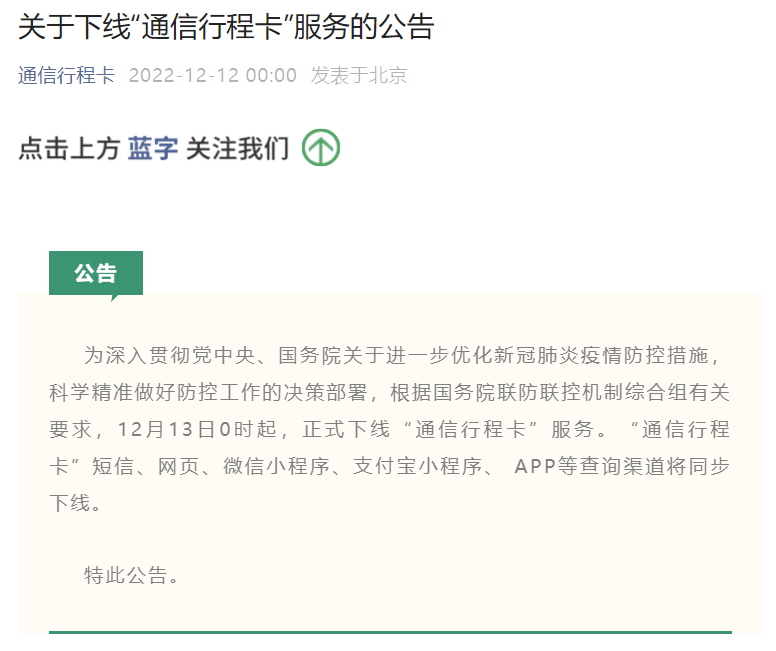

At 0: 00 on December 12, the communication travel card issued an official announcement, and the "communication travel card" service will be officially offline the next day. This means that after the cancellation of the nucleic acid certificate of flying by plane and train, another cross-city and inter-provincial travel restriction measure has also been officially cancelled.

According to the data of Ctrip’s FlightAI market insight platform, domestic passenger traffic recovered to about 40% in the same period of 2019 from December 7 to 11, and the overall search fever has recovered to the top 80% of the epidemic. After the cancellation notice of communication itinerary card was issued, from 0: 00 to 13: 00 on December 12, the search popularity of products such as cross-provincial travel, vacation and so on in Spring Festival travel rush was 12 times higher than that in the same period last week, and the search volume of air tickets was basically the same as before the epidemic.

Up to now, the TOP10 destinations for Spring Festival travel rush flights are: Shanghai, Beijing, Sanya, Shenzhen, Chengdu, Guangzhou, Haikou, Harbin, Changchun and Hangzhou.

According to the data of Qunar, since December 7th, the booking volume of air tickets in Spring Festival travel rush (January 7th-21st, 2023) has increased substantially, nearly 8.5 times than that of a week ago, and the booking volume of train tickets in Spring Festival travel rush has also increased significantly.

Since the release of the "New Ten Articles" on epidemic prevention, the civil aviation market has entered the fast lane of rapid recovery, maintaining a daily growth of 5%. At present, the cancellation rate of flights in Beijing, Shanghai, Guangzhou, Shenzhen, Chengdu, Chongqing, Hangzhou and other important civil aviation airports has decreased, and the supply of effective flight seats has been increasing. On December 11, the number of departing passengers reached the peak after the 11 th holiday.

In 2023, the number of air ticket bookings in Spring Festival travel rush will reach the peak in the past three years.

In addition to the orders for immediate travel, the number of air ticket bookings in Spring Festival travel rush has increased significantly. On the Qunar platform, since December 7th, the number of air tickets booked during Spring Festival travel rush (January 7th-21st, 2023) has increased significantly, nearly 8.5 times than that of a week ago. TOP10 destinations are Harbin, Sanya, Chengdu, Haikou, Shanghai, Changchun, Shenzhen, Shenyang, Beijing and Kunming.

With the increase of booking volume, the average payment price of air tickets continues to rise. Before the epidemic, air ticket prices in Spring Festival travel rush were all high in a year, and it was often hard to get a ticket for popular routes. Qunar platform predicts that many routes will return to the pre-epidemic situation this year. The peak of air ticket booking in Spring Festival travel rush will be advanced before the train ticket is invoiced, and the price is expected to remain at a high level after one week. The query of Qunar shows that the economy class air tickets from Beijing, Shanghai, Hangzhou and other cities to Sanya, Kunming and other tourist cities during Spring Festival travel rush are close to the full price.

Guo Lechun, vice president of Qunar Big Data Research Institute, analyzed: "The recent increase in air ticket bookings in Spring Festival travel rush reflects the simple desire of everyone to go home for the New Year, and the potential demand exists. However, the demand side also shows structural characteristics: some people have to travel even if they strengthen their protection, while others are more cautious. Therefore, all demand cannot be completely released. From the supply side, at present, the number of planned flights is 90% before the epidemic. After the epidemic prevention and control measures are optimized, it will take some time for airlines and airports to restore their capacity. It is estimated that the booking volume of air tickets in Spring Festival travel rush will reach the peak in the past three years in 2023, which is close to 80% before the epidemic. "

Xie Xiaoqing, a senior researcher at Ctrip Research Institute, said that less than one month after the opening of Spring Festival travel rush this year, the mentality of tourists has changed from wait-and-see to direct action under various restrictions and optimization. With the first release of the mobility of business travelers, the Spring Festival on New Year’s Day will usher in a significant increase in the number of tourists visiting relatives and vacationing, and consumer markets such as traditional winter ice and snow tours and warm winter tours are also expected to usher in substantial recovery.

Multi-site tourism bureau issues subsidies and free tickets.

Under the eager desire of tourists to travel, many tourism bureaus have also "sacrificed big moves" to promote market recovery.

On December 10th, Jiuquan Municipal Bureau of Culture, Sports, Radio, Film and Television and Tourism of Gansu Province issued a number of measures to support the recovery of the industry, and comprehensively promoted the resumption of production of the city’s cultural tourism industry. The notice requires that all counties (cities, districts) should continue to implement the preferential policy of "attracting customers into wine" and continue to suspend the payment of tourism service quality deposits for qualified travel agencies to ease operational difficulties for travel agencies; During the period from December 1st to March 31st of the following year, winter and spring tourism subsidies will be implemented, and the amount of subsidies for charter flights and special trains will increase by 50%; Implement the city’s state-owned A-level tourist attractions ticket reduction and exemption policy; The scenic spots such as Dunhuang Mogao Grottoes, Moon Spring in Mingsha Mountain, Yumenguan in Dunhuang, and Axeboro Zhuanjing Film and Television Base are free of charge for primary and secondary school students nationwide, and the preferential policy of 50% discount for ordinary tourists (until March 31 of the following year); Continue to implement the policy of reducing or exempting tickets for citizens of Jiuquan and Jiayuguan in some scenic spots in Jiuquan City, and reduce or exempt the first tickets for Huyanglin Scenic Spot in Jinta Desert, Huacheng Lake Scenic Spot and Mingzu Style Garden Scenic Spot in Subei Danghe Canyon; Jiuquan Fukang Tianbao Scenic Spot is free of charge on weekends, and a 50% discount policy is implemented on non-weekends.

From December 10th to March 31st, 2023, the Pingshan Lake Grand Canyon Scenic Area in Zhangye, Gansu Province has implemented a policy of admission free of charge for tourists from all over the country. With my ID card, you can visit and experience the unique charm of the magic canyon by paying the sightseeing fare in 30 yuan.

Jinzhong City Culture and Tourism Bureau of Shanxi Province announced that from now until the working day of December 31, 14 scenic spots including Pingyao Ancient City, Jiexiu Mianshan, Qiaojia Courtyard, Zhangbi Castle and Changjia Manor will offer preferential policies for ticket reduction and exemption to national tourists. Among them, Pingyao Ancient City, Shuanglin Temple, Zhenguo Temple, Changjia Manor, Yuci Old City, Wujin Mountain, Huangtu Nongyan and Mingle Manor are free of entrance tickets, while Jiexiu Mianshan, Qiaojia Courtyard, Zhangbi Castle, Hougou Ancient Village, Little Wutai Mountain and Shima Temple are half-price tickets.

Xinjiang Cultural Tourism Department will issue coupons for ice and snow tourism from late December this year to February next year, and Sanya Tourism Promotion Bureau will continue to carry out post-epidemic tourism market revitalization activities with the theme of "Easy to Sanya"; Guangxi Baijia Scenic Area offers a 50% discount on the first ticket for tourists from all over the country; In response to a number of favorable travel policies … On December 8, Ctrip also officially launched the "Plan A for Tourism Revitalization in 2023", announcing that it would launch a "triple strategy" to help industries and destinations "reunite" with travelers.

It is understood that Ctrip’s New Year’s Day and Spring Festival ticket purchase calendars have also been launched. On December 17, the New Year’s Day train ticket will be officially sold, and the New Year’s Eve train ticket will be sold on January 7.

Freedom of travelers to return home

"Can you go back to your hometown?" "In case of infection on the road, will it be isolated?" Where is the platform to organize customer service forces? On these two questions, I asked nearly 100 counties and cities across the country to help passengers who want to book tickets to go home.

According to incomplete statistics, in most of the counties and cities that have been inquired, the card points of expressways, high-speed railway station and other transportation hubs have been cancelled, and passengers can return home except those areas that have not yet issued the return home policy. Among them, first-line and new-line big cities such as Beijing, Shanghai, Guangzhou, Chengdu and Chongqing, important work areas such as Harbin in Heilongjiang Province, Liupanshui in Guizhou Province, Zhangjiakou in Hebei Province and Xinyang in Henan Province, as well as Zhaotong in Yunnan Province and chibi city in Hubei Province can all go freely as before the epidemic, accounting for about 30% of the total. In addition, most areas need to report on the official APP and applet in advance, or directly report to the community where they live before returning home.