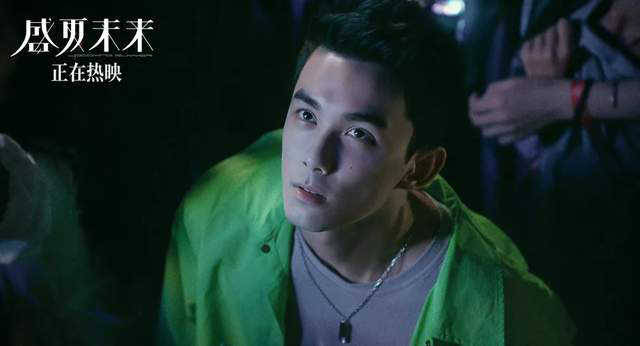

Bi Gan’s roadside picnic was a blockbuster.

Special feature of 1905 film network The start-up capital was only 40,000 yuan. After two months of filming, the crew was dissolved. Bi Gan, the sound engineer, the literary planner and his wife made up another month, finishing some shots about the train and the last 15 minutes of the film. Previously, Bi Gan had accepted many interviews and talked about the situation of "food shortage" when shooting. Often, there was no money when shooting, but someone would call some money, but in the end, "it was really impossible to shoot for two months."

When filming, all the crew members will also play truth or dare together, and Bi Gan will use various ways to get everyone together, cheer up and increase their trust in themselves. Bi Gan said that in fact, he can be regarded as a leader among his friends since he was a child, and playing basketball in primary school and junior high school is always a leader.

Who would have thought that more than a year later, Bi Gan won the Best New Director Award in the 52nd Taiwan Film Golden Horse Award for his play. At that time, the candidates included Alec Su, Guoqiang Xiang and others. Bi Gan, who was born in 1989, became a blockbuster, and the roadside picnic was also noticed by more people.

Bi Gan has been recognized by many people for his first appearance, and "Roadside Picnic" has also entered this crowded summer file. Can it be recognized by the audience? He said: Leave it to fate.

The audience doesn’t have to interact with me, so they don’t have to accept the roadside picnic.

The play was filmed in Kaili, Guizhou, which is Bi Gan’s hometown. He said that he was lazy and it would be convenient to film in Kaili. Almost all the films are unprofessional actors, and the hero is Bi Gan’s uncle. These relatives and friends have helped him before and starred in two short films. This time, they got together again and made a long film.

The story of the roadside picnic can be divided into three sections, the scene, the past and the future, which will not be incomprehensible, but it is also different from other linear narrative films. There is a 40-minute long shot in the film, and the audience can follow the photographer to see that the male host seems to have returned to the past and met the future characters. When watching, I can feel the photographer bumping in the car and stumbling when walking. Bi Gan said that the scene was filmed three times, and finally the first material was selected. Although there were flaws, the best parts, such as singing, were retained, and the relationship between the characters could be reflected. He also laughed and said that as for the technical flaws, there was really no way. "Everyone can hate this movie because of this." This shot, praised by many people, is just a technique in Bi Gan’s eyes, and the script needs to be filmed.

1905 Movie Network: Did the two-month shooting period achieve what the script wanted to express?

Bi Gan: Yes, I did. I shot 70% in the first two months. Everyone really couldn’t hold on. They were all very tired. Everyone had something to do and had helped me for two months. I said, let’s disband. I have finished most of it. Finally, I will do some finishing work myself.

1905 Movie Network: Is the final shot different from the original idea?

Bi Gan: There is definitely no difference in imagination. Writing is not to execute my script later. Writing is to make a blueprint. That blueprint is an alternative, and shooting on the spot is the moment of creation.

1905 Movie Network: Do you pay more attention to the process?

Bi Gan: The film is definitely a process. As for what can be achieved, it should be resigned to fate.

1905 Movie Network: New directors may want to let more people know themselves through their works?

Bi Gan: Why do you know me?

1905 Movie Network: Do you think movies are made for yourself?

Bi Gan: Of course, movies are for people, but it has nothing to do with me. I used all kinds of methods and spent time hiding my feelings and turning them into works. It is good for everyone to interact with the works. It has its own vitality. There is no need to interact with me. I don’t know everyone and everyone doesn’t know me.

1905 Movie Network: There are many scenes in which the hero reads poems. When did you start writing poems?

Bi Gan: Fifteen or sixteen years old, (time is not short) right, so it’s very long, so it’s not like a novice. We used to write homework for more than ten years, and you have left qq space for more than ten years, so it’s almost the same. We should be about the same age in writing lyric, and we have been lyric with words for more than ten years.

1905 Movie Network: Are you worried that the audience will not understand why they want to read poetry?

Bi Gan: Then you can also question why you don’t understand the lighting and the clothes worn by the actors. Poetry is probably the same, that is, sound, light and it are all elements inside. There is nothing you don’t understand, that is, you can’t accept it. If you accept it, you can go to him and interact with him. If you don’t accept it, there is nothing you can do.

1905 Movie Network: Do you think the audience will accept this play?

Bi Gan: Whatever (laughs).

1905 Movie Network: I feel that you are very open-minded.

Bi Gan: Sorry about the issuer. I don’t think so openly. I don’t know this. I don’t know everyone. There are 10,000 people in the audience. But if there are at least 20 people who are my friends, I will explain to them. I don’t know the rest. I may have no contact with you all my life, or my works will have contact with them. So what’s the point for me? I don’t think it’s meaningful. I hope you can convince me.

1905 Movie Network: Let you explain this movie now. What would you say?

Bi Gan: I explain it differently from everyone. I think this movie is an animation, just like an animation, where the innocence is particularly pure.

1905 Movie Network: Where is innocence reflected?

Bi Gan: A place for singing and walking.

1905 Movie Network: The theme that your works want to express has always been time?

Bi Gan: As I said just now, there is really nothing else. In France, many directors can discuss the relationship between people and love, which is very profound. I may not be able to understand that. What I can understand in my twenties is something particularly pure, time and memory.

Capital can’t control movies. I will only be happy when I am creating.

When I was a child, Bi Gan’s parents divorced. He grew up with his grandmother, so he was particularly independent in life, "because he needed to be taken care of". However, in thinking, Bi Gan said that he was very independent, "because he didn’t have to listen to anyone".

When he was a freshman, Bi Gan saw andrei tarkovsky’s films and came up with the idea of making movies, because it was "a way of expression". Then he made two short films, Tiger and Diamond Sutra, and was shortlisted for many film festivals. After graduating from college, I began to join the film industry. My family didn’t support it, but it was only a few years. In Bi Gan’s words, "I’ll just rely on it."

There was still no money when filming "Roadside Picnic". After filming, I won the prize, and after I became famous, the capital came to me. Those who seek cooperation will meet and talk with Bi Gan after screening by producers. If there is no common pursuit, it will be "game over". Facing the influx of investors, Bi Gan can see clearly that he can’t control his own creation and impose it on his unsuitable actors.

Today, Bi Gan has signed contracts with different companies, including directors and brokers, and has formed his own company with his partners. The following work is very full, but he is not sure whether he will always be a director. "It’s tiring to think about filming, but will there be a back after finishing?" I don’t know. I’m resigned. "

Next, Bi Gan will make a film called The Last Night of the Earth, with an investment of about 10 million yuan. It is a "country detective film that cannot be typed", and there will be elements of revenge, with new people and old people coming on stage together, but the new actors may not be stars.

1905 Movie Network: What’s the next plan?

Bi Gan: In August, I will help the Golden Horse film beat a one-minute image film, and then in April next year, I will shoot a long film called The Last Night of the Earth.

1905 Movie Network: Will the newcomers in the new film be familiar faces that everyone knows?

Bi Gan: Maybe it’s a truck driver, not necessarily an actor, not necessarily everyone knows, maybe it’s a star. I don’t care if it’s suitable or not.

1905 Movie Network: You don’t reject the All-Star cast?

Bi Gan: I don’t reject it more and more, because I feel that the constant use of non-professional actors is to remove his identity, so why can’t other professional actors remove his identity? Wouldn’t it be nice if it’s suitable and everyone communicates smoothly?

1905 Movie Network: What if some stars have more dominance on the set than themselves?

Bi Gan: Look at how big he is. If he thinks he is taller than me, I’m definitely not afraid of you. But if you want to put forward the reasons for this detail, I will listen carefully and find a better solution with you. If your way can be solved better, then I will fully respect you, because my purpose is not to be a director, but to make a good work.

1905 Movie Network: Is there much investment in finding you now?

Bi Gan: A lot. People who come to me generally want me to make my own movies, and he can’t let me shoot Spider-Man. If I do, he will go crazy.

1905 Movie Network: Do you promise to create instead of being dominated by capital?

Bi Gan: Capital and technology are all for helping me to make movies, not for me to serve them. These people who come to me know very well that all the capital is for making movies better.

1905 Movie Network: If the investor asks which actor to use, will you agree?

Bi Gan: Then if his actor is particularly good, I will compromise. If his actor is not good, it is impossible to compromise. If he is particularly suitable, I think you have a vision as an investor, and I should compromise with you.

1905 Movie Network: Aren’t you afraid to offend anyone?

Bi Gan: I don’t depend on anyone.

1905 Movie Network: If you don’t shoot this play, will life be guaranteed?

Bi Gan: No, The Roadside Picnic really allows me to write freely now, but I would have been poor before, but who is not poor in my twenties?

1905 Movie Network: You are only 27 years old now.

Bi Gan: 27 years old … … Then my friends around me can guarantee their own lives when they become civil servants. Before that, we were all poor together, so I think the stage is more consistent and the luck is better. It is a very glorious thing to be able to do art to support themselves.

1905 Movie Network: Many artists who can’t support themselves finally gave in.

Bi Gan: That’s not his fault.

1905 Movie Network: Will you insist on uncompromising?

Bi Gan: The most important thing is that I believe my work is good, so I am willing to pay. If my work is not good or I just want to run an identity, what the hell? Why should I do this? It’s good to work so hard every day and harm others and yourself, but if it’s valuable, you can talk to time memory so that the watching human body will notice it and understand it. If it’s so valuable, you should shoot it well and take out your own ideas.

1905 Movie Network: I heard that you still live in Guizhou?

Bi Gan: Because my home is over there. Of course, I will live there where my home is.

1905 Movie Network: Didn’t you want to live in Beijing?

Bi gan: there is no such reason, mainly.

1905 Movie Network: What kind of reasons will come?

Bi Gan: My family is coming. My children will come when they go to school here.

1905 Movie Network: Most directors may want to live here, and the resources will be better?

Bi Gan: What’s the use? It’s just as bad as shooting. I mean, the most critical moment is to spend time writing well, which is more useful than anything else. Some directors think that Beijing is very comfortable, so it’s already very good. You can write well here. The reason for choosing a place to live is because you are comfortable.

1905 Movie Network: When I was a child, there didn’t seem to be so much communication with my parents?

Bi Gan: In life, it is special that you will not be independent, because you need to be taken care of and grow up with your grandmother. But in thinking, I will be particularly independent, because I can listen to different people.

1905 Movie Network: Will childhood experiences affect the present?

Bi Gan: But I hope my child … … My wife and I can give him a very good family, and we can have a more sound family. Don’t be an artist, just be a normal and ordinary person and have a happy life.

1905 Movie Network: So you are unhappy as an artist?

Bi Gan: It’s because I’m only happy when I’m creating. Creation has helped me solve many problems, but he doesn’t have to create this problem. He doesn’t have that problem himself.

1905 Movie Network: Are you unhappy because of your childhood experience?

Bi Gan: I don’t think it’s so melodramatic. Most artists value themselves too much.