BYD: The Best Mid-year Report in History Encountered the Reduction of Stock God.

Only after handing over the best mid-year report in history, BYD (002594.SZ) immediately encountered the test of investor confidence by Buffett’s reduction.

Since 2022, BYD’s various businesses have generally been "opened". In terms of new energy vehicles, sales exceeded 100,000 vehicles for five consecutive months, and surpassed Tesla to top the global sales in the first half of 2022. At the same time, the installed capacity of power batteries has steadily increased. In May, it surpassed LG in the installed capacity ranking of global power battery enterprises and became the second in the world.

Under the blessing of two ace businesses and high market valuation, BYD ushered in an unexpected but unexpected Davis double click — — On June 10th, BYD’s total market value successfully exceeded one trillion, becoming the first domestic automobile brand with a market value exceeding one trillion.

But there were Ning Wang and Tesla before, followed by Wei Xiaoli. Can the trillion "Diwang" take the lead in the increasingly white-hot global new energy vehicle war and bring more imagination beyond the valuation of nearly 300 times?

Berkshire’s answer now seems to be no: for the first time in 14 years, it reduced its holdings by more than 6 million shares. There are still 219 million shares in hand, will the market outlook continue to cash out? This makes the market quite a bit floating.

Go back to the basic disk. BYD has been building its own winning weapon for many years — — The industrial chain layout and vertically integrated business structure have made it frequently criticized, and now it is highly respected and has become "the only company that has completely withstood the blockade, chip shortage and rising raw material prices".

After the profit turning point, whether BYD’s whole industrial chain layout can escort and promote its sustained high growth, and how unique industrial ecological landscape will be generated, this paper will deconstruct and analyze its two main businesses, new energy vehicles and power batteries, and find out.

The full text is long, mainly from the following aspects:

New energy vehicle business

1.1 Upstream chip: self-core-made, and it has become the power semiconductor faucet of domestic vehicle specifications.

1.2 Mid-stream auto parts: Can the "Foday System" be both internal and external?

1.3 intelligent mid-stream vehicles: self-research capability needs to be improved.

1.4 Downstream production base: The layout quantity is relatively advanced.

Second, the power battery business

2.1 upstream lithium ore and raw materials: self-production and equity participation.

2.2 Battery technology and key equipment are independently developed.

2.3 layout power battery recycling, trying to solve the demand for raw materials.

2.4 The production capacity continued to expand, adding multiple production bases.

I. New energy vehicle business

Cars are undoubtedly BYD’s most profitable business segment.

In the first half of 2022, BYD sold 646,400 vehicles, up 162.03% year-on-year, of which 638,200 were new energy passenger vehicles, up 324.84% year-on-year, and the domestic market share reached 24.7%, up over 7.5 percentage points from 2021.

In terms of revenue, in the first half of 2022, the proportion of automobiles, related products and other products in total revenue increased from 52.20% in the first half of 2021 to 72.55% in the first half of 2022, achieving revenue of 109.267 billion yuan, a year-on-year increase of 130.31%.

In terms of profit, BYD ended the situation of increasing income without increasing profit. In the first half of the year, it realized a net profit of 3.029 billion yuan, a year-on-year increase of 721.72%.

"BYD has a high configuration and a low price, so it sells well. After its market share is stable, it will gradually raise prices and its profitability will improve." A new energy fund manager said that the complete industrial chain layout has also promoted BYD’s profitability.

Wang Chuanfu once said that foreign suppliers despises new independent brands and can only rely on themselves at first. It is both a challenge and an opportunity. It is from the initial forced "self-production and self-supply" that BYD has stepped forward to the present.

1.1 Upstream chip: self-core-made, and it has become the power semiconductor faucet of domestic vehicle specifications.

In 2002, BYD set up the integrated circuit design department, which started almost simultaneously with its plan to build cars and batteries. In 2004, IT officially entered the field of microelectronics and optoelectronics in the IT industry, and BYD Microelectronics was established, which was later BYD Semiconductor. Recently, BYD Semiconductor has submitted a prospectus to Shenzhen Stock Exchange, intending to be listed on GEM.

BYD has been developing its own chips for 20 years, and now it has become the largest power semiconductor IDM enterprise in China. According to BYD Semiconductor’s prospectus, the company’s main business is divided into five sectors: power semiconductor, intelligent control IC, intelligent sensor, photoelectric semiconductor, manufacturing and service, and the revenue in 2021 accounts for 43.22%, 13.46%, 19.25%, 18.69% and 5.38% respectively.

Among them, the power semiconductor business with the largest proportion of revenue mainly adopts IDM business model, and has formed a complete industrial chain including chip design, wafer manufacturing, module packaging and testing, and system-level application testing. The products mainly include IGBT chips, FRD chips, IGBT modules, IGBT single tubes, IPM modules, SiC modules, etc., which are applied to new energy vehicles and other fields.

BYD Semiconductor has set up an IGBT R&D team since 2005. IGBT can convert direct current into alternating current, which is an indispensable device for new energy vehicles. At present, the company’s vehicle-class IGBT module has matched BYD’s new energy vehicles, and the total shipment volume ranks first in China, breaking the monopoly of overseas manufacturers.

At the same time, BYD Semiconductor is also the first power semiconductor enterprise in the world and the only one in China to realize the large-scale loading of SiC three-phase full-bridge modules in motor drive controllers of new energy vehicles. It has broken through technical problems such as high-temperature packaging materials, long-life interconnection design, high heat dissipation design and vehicle regulation level verification, and realized the large-scale application of SiC modules in high-end models of new energy vehicles.

Intelligent control IC products include MCU chip, power IC and BMSAFE chip. At present, Fabless business model is mainly adopted.

In the field of vehicle regulation MCU, BYD Semiconductor is also the first echelon in China. The company’s car-level 8-bit MCU chip has been mass-produced since 2018, and is mainly used in automotive electronic control scenes such as car lights and car buttons; The 32-bit MCU chip of vehicle regulation level is designed according to the requirements of ISO26262 safety level standard, and it integrates various communication modules, which can be applied to automotive electronic control scenes such as electric windows, electric seats, wipers, lights and instruments.

Wang Chuanfu once said that the electrification of automobiles has brought about great changes that have never happened in a hundred years, and the industrial supply chain system is bound to be reconstructed. "In the field of semiconductors, the demand for semiconductors in electric vehicles is 5-10 times higher than that in traditional vehicles. Electric cars are in the first half, smart cars are in the second half, and smart cars have greater demand for semiconductors. "

However, there are only a handful of car companies that make their own chips. After all, the research and development cycle is long and the investment is large, which is not cost-effective, especially the IDM model with heavy asset investment.

In the tide of core shortage that swept the world in the past two years, automobile chips were in the most shortage, especially the power semiconductor of automobile gauge and MCU in vehicle. The advantages of BYD’s self-made chips were fully reflected.

Can BYD Semiconductor supply in bulk to other car manufacturers in the future? At present, in addition to supplying BYD Group, its vehicle-grade power semiconductor products have entered the supply systems of manufacturers such as Xiaokang Automobile, Yutong Automobile, Foton Motor, Ruiling, Beijing Times, Invigorate, Blue Ocean Huateng and Huichuan Technology, but in 2021, the revenue from BYD Group still accounted for more than 60%.

1.2 Mid-stream auto parts: Can the "Foday System" be both internal and external?

1.2 Mid-stream auto parts: Can the "Foday System" be both internal and external?

"BYD’s overall supply chain was relatively weak during the epidemic. Some core components were done by its own business department, and the control of the supply chain was relatively in place." A new energy analyst of a brokerage recently said in an interview with CBN.

In March 2022, BYD launched an independent Foday brand and officially announced the establishment of Foday Company. The company has operational autonomy and the core components of new energy are sold to the outside world.

According to Wang Chuanfu, as a sub-brand of BYD, Foday Department is a complete auto parts supporting system, which is an inevitable choice for BYD after years of vertical integration. After the split, it will be priced according to the market-oriented mechanism to form a profit center.

According to Wang Chuanfu, as a sub-brand of BYD, Foday Department is a complete auto parts supporting system, which is an inevitable choice for BYD after years of vertical integration. After the split, it will be priced according to the market-oriented mechanism to form a profit center.

On the one hand, Foday Company guarantees the safety of BYD’s industrial chain, on the other hand, it can broaden the company’s growth space through external supply, which is expected to open a second growth curve in the field of auto parts.

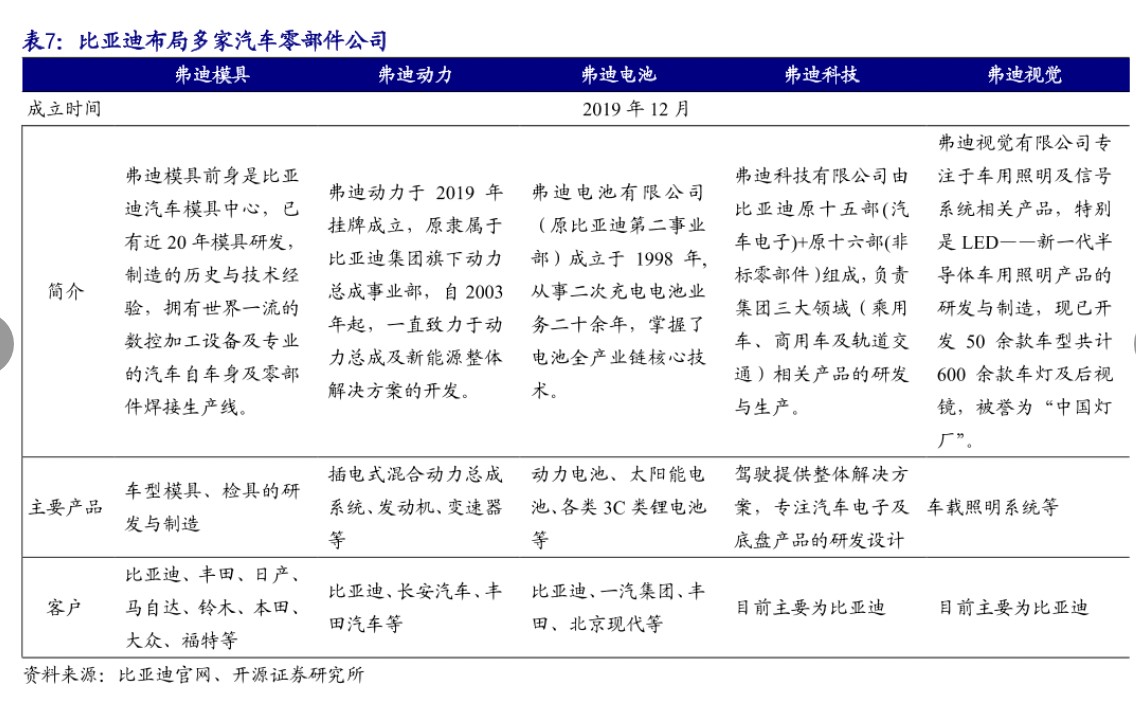

Up to now, BYD has five auto parts companies: Foday Mould, Foday Power, Foday Battery, Foday Technology and Foday Vision, and through these five companies, it has realized self-supply in the fields of power battery, electric drive system, electric vehicle platform, thermal management system, lighting system and battery management system.

In terms of batteries, since 2020, Foday Battery has established a number of "Foday Department" battery companies.

From Bengbu Fudi Battery Co., Ltd. in 2020 to Wuwei, Yancheng, Jinan, Shaoxing, Chuzhou, Fuzhou Fudi Battery Co., Ltd. and Chongqing Fudi Battery Research Institute Co., Ltd. in 2021, and then to Xiangyang, Taizhou, Nanning, and Guangxi Fudi Battery Co., Ltd. in 2022, the total number is more than ten.

In February 2022, the power battery project of FAW Fudi New Energy Technology Co., Ltd., which was jointly registered by China FAW Group and BYD, officially started. With a total investment of 13.5 billion yuan, the project can meet the configuration requirements of 600,000 electric vehicles every year after it is completed and put into operation, and realize an annual output value of more than 20 billion yuan.

In terms of electric drive, in March 2022, Skyworth Motor released the Skyworth HT-i model. Some insiders said that the Skyworth HT-i model adopted the HT-i system developed by Foday Power and Skyworth, and the HT-i system was tailored for Skyworth Motor.

As early as 2019, BYD released the "BYD New Energy Vehicle Parts Selection Manual", which externally supplied core components such as powertrain, motor, electronic control and power supply.

1.3 intelligent mid-stream vehicles: self-research capability needs to be improved.

BYD, which started from the traditional manufacturing industry, did not have the conditions to impact the high-end in the era of fuel vehicles. With the advent of the intelligent era, BYD’s self-research and foreign cooperation were driven by both, and it got the tickets for the second half in advance.

Yang Dongsheng, vice president of BYD and president of Product Planning and Automotive New Technology Research Institute, once said that the core of automotive intelligence lies in the intelligent cockpit. After three years of development, BYD’s DiLink system applied to the intelligent cockpit has launched version 4.0 in 2021.

Previously, in the second half of 2020, BYD Intelligent Networking Center also released DiPilot, an advanced intelligent driving assistance system for automobiles, for the first time, which includes DiDAS intelligent assistance technology and DiTrainer coaching mode.

At present, BYD’s main subsidiary, Foday Technology, is engaged in research related to intelligent cockpit, ADAS and vehicle networking. The specific products include multimedia systems, blind spot monitoring systems, automatic parking, panoramic images and intelligent forward-looking. At the same time, Foday Seiko has relevant layout in smart car, and its specific products are lighting combination headlights and rear lights, rearview mirrors, indoor and outdoor photo lamps, etc. In addition, the Automotive Smart Ecology Research Institute is engaged in the research and development of open smart car platforms, smart customer relationships and smart car applications.

However, compared with electrification, BYD’s intelligent self-research ability needs to be improved.

"It is difficult for BYD to make breakthroughs in intelligent driving and software systems. Now it is basically the world of Huawei and several foreign players." The above fund manager said. There are even more extreme voices saying that BYD’s shortcomings in the direction of intelligence are as obvious as its advantages in electrification.

Among them, hardware configuration and OTA (over-the-air download technology) are the main gaps between BYD and the new car-making forces.

The Qualcomm Snapdragon SM6350 chip used in BYD DiLink 4.0 platform is a mid-to high-end processor, while the mainstream cockpit chips of Tucki P5, Weilai ET7 and ET5 all use Qualcomm Snapdragon SA8155P chip. SA8155P chip is the top-level chip in Qualcomm, and it is in the first echelon in the automotive chip industry. At the same time, BYD has also faced problems such as upgrade trouble and poor user experience in OTA.

Judging from the layout of BYD’s R&D, it seems that the company really prefers electrification. In 2021, BYD’s R&D investment reached 10.63 billion yuan, a year-on-year increase of 24.20%. The projects involved mainly included blade battery technology, energy storage products (BMS-active) and DM-i super hybrid.

How will BYD handle itself in terms of intelligence?

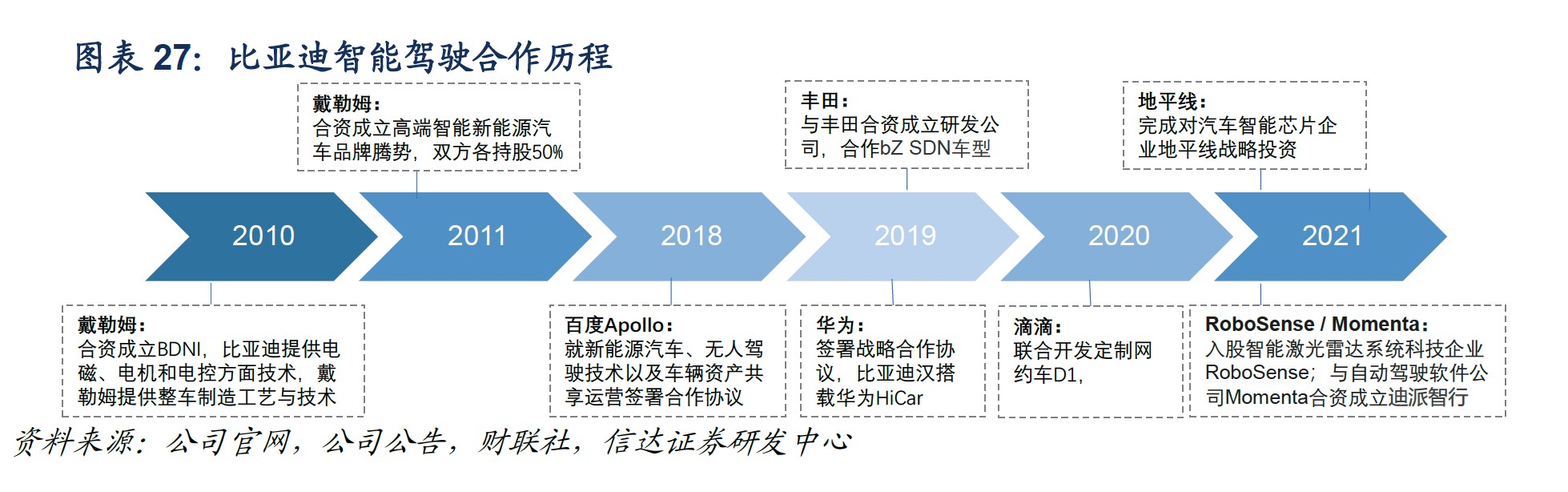

At the same time of self-research, BYD chose to strengthen cooperation with the outside world in an effort to make up for the shortcomings of the industrial chain.

In 2018, BYD and Baidu Apollo signed cooperation agreements related to new energy vehicles, driverless technology and vehicle asset sharing operations.

In 2019, BYD signed a strategic cooperation agreement with Huawei, and BYD Han was equipped with Huawei HiCar;; In March 2021, the company strategically invested in Horizon, an automotive smart chip enterprise; In November 2021, Momenta, a company related to autopilot software, established a joint venture company "Dipai Zhixing" for high-level autopilot layout; In December 2021, it reached a strategic cooperation agreement with sagitar Juchuang (mainly engaged in intelligent lidar system), and officially led sagitar Juchuang in February 2022. In February 2022, Baidu was selected as the supplier of intelligent driving system; In March of the same year, it reached a cooperation with NVIDIA, and it is planned to install NVIDIA DRIVEHyperion platform on some vehicles in the first half of 2023 to realize a higher level of intelligent driving function.

1.4 Downstream production base: the layout quantity is relatively advanced.

1.4 Downstream production base: the layout quantity is relatively advanced.

In April 2022, when the epidemic was serious, BYD’s pure electric and plug-in hybrid products were ranked first in the sales of passenger car brands.

The reason why BYD’s sales volume can ride the dust, in addition to the materials needed for self-supply, the widely distributed production base also contributed.

Compared with enterprises such as Weilai, Ideality and Tesla, which have only one production base in China, BYD has built four automobile production bases in Shenzhen, Xi ‘an, Changsha and Changzhou. In June 2022, the first complete vehicle Qin PLUSDM-i of BYD Hefei Base Phase I was successfully rolled off the assembly line, and five other factories, including Fuzhou, were under construction. This means that once there is an emergency, BYD can minimize the risk of downtime.

According to the data of China Investment Network, as of May 2022, BYD’s annual production capacity has reached 1.3 million vehicles, and it is expected to reach 3.4 million vehicles in 2022. With the steady implementation of mass production plans of some factories, the vehicle production capacity will reach 4.05 million vehicles in 2023, and the scale effect will be further revealed.

It is reported that at present, BYD’s four bases in Jinan, Hefei, Zhengzhou and Shenshan all adopt the mode of "parts+whole vehicle", which can predict in advance to reduce the accumulation of parts and spare parts and reduce the stocking cost as much as possible.

Second, the power battery business

The struggle between Ferrous lithium phosphate and Sanyuan never stopped. Wang Chuanfu, who has worked with batteries for decades, insists that BYD can only find a way out in China and the world if it is Ferrous lithium phosphate. Despite the twists and turns, BYD finally won back the main battlefield of lithium iron phosphate battery with its high-performance blade battery.

According to the data of China Automotive Power Battery Industry Innovation Alliance, with the accelerated loading of blade batteries, the installed capacity of BYD power batteries increased from 16.2% in 2021 to 22.25% in the first seven months of 2022.

However, the financial report shows that in 2021, BYD’s secondary charging and photovoltaic business (including power battery business) achieved revenue of 16.471 billion yuan, a year-on-year increase of 36.72%; The gross profit margin was 11.94%, down 8.22 percentage points year-on-year.

To say who is holding back the profitability of power batteries, the high probability is the lithium mine whose price is "constantly rising". BYD’s power battery business has undoubtedly faced the challenge of high raw material prices since 2021. In fact, in order to stabilize the supply chain and control the battery cost, BYD has been trying to enter the upstream lithium mine field in recent years, and at the same time, it has intensified its efforts to lay out the middle-stream lithium battery equipment, downstream power battery recycling and other businesses.

2.1 upstream lithium ore and raw materials: self-production and equity participation.

In March, 2022, Wang Chuanfu said at the committee of 100 Forum on Electric Vehicles in China that the soaring price of battery raw materials was a challenge that the industry needed to overcome. He suggested that the layout and production capacity of lithium carbonate resources should be comprehensively sorted out, the domestic mining volume and foreign imports should be increased, and the price expectation should be stabilized.

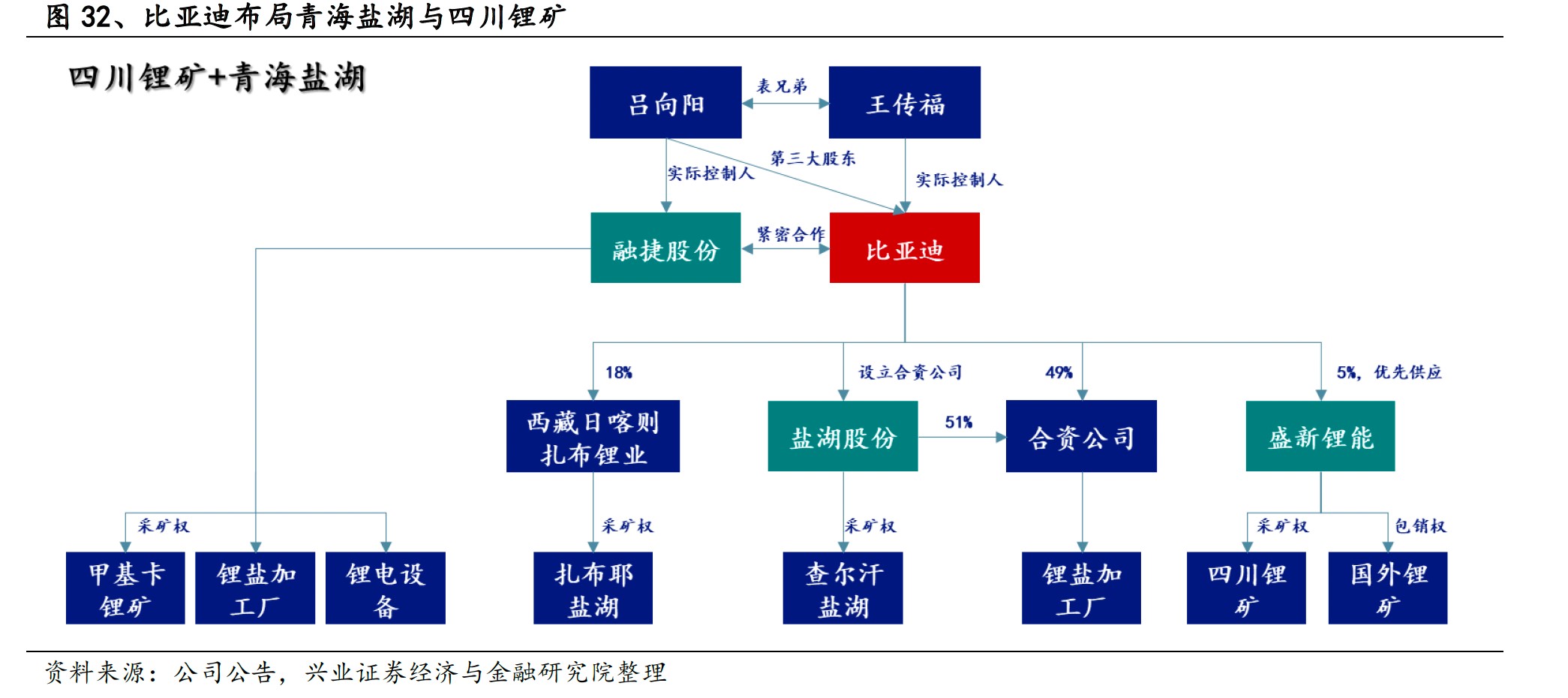

BYD mainly arranges lithium resources by investing in lithium resource enterprises, establishing joint ventures with lithium resource enterprises, and directly purchasing lithium mine mining rights.

As early as 2010, BYD invested about 200 million yuan to acquire an 18% stake in Zabuye High-tech Lithium Industry Co., Ltd. in Shigatse, Tibet. According to the data, Zabuye High-tech Lithium Industry is a holding subsidiary of Tibet Mining and has the exclusive mining right of Zabuye Salt Lake for 20 years. The salt lake is the third largest lithium mine salt lake in the world and the largest in Asia, with proven lithium reserves of 1.841 million tons.

Since 2022, the company’s lithium resource layout has been more intensive. In January, BYD won the bid of $61 million for the Chilean lithium mine, but unfortunately the project was stopped by the local court; In March, it is planned to invest 3 billion yuan in Shengxin Lithium Energy. In April 2022, the company signed an agreement with Yinhe Lithium Industry to purchase 60,000 tons of lithium concentrate every year. At the same time, the planned new 60,000-ton lithium salt project in Indonesia is expected to be put into production in 2023. At the end of March, BYD Auto Industry, a subsidiary, invested 6 million yuan and held 30% of the shares, and set up a mining company with Sichuan Luqiao, aiming at developing Sichuan lithium mine resources; In May, it was reported that BYD had found six lithium mines in Africa, all of which had reached the acquisition intention. The output of lithium carbonate in these six lithium mines is reported to reach 1 million tons, which can cover the company’s raw material demand in the next decade.

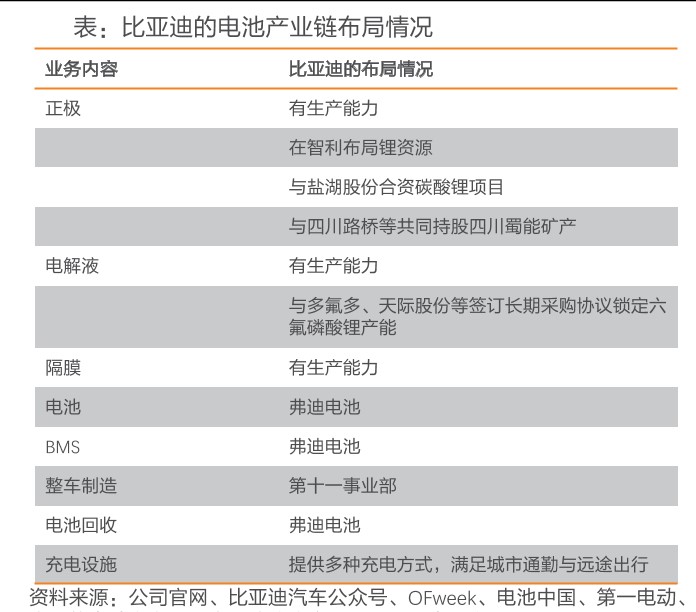

As for cathode materials, BYD, as an enterprise specializing in lithium iron phosphate batteries, can imagine the demand for Ferrous lithium phosphate. Therefore, on the basis of self-research and self-production, the company also guarantees the supply through the mode of foreign equity participation.

As for cathode materials, BYD, as an enterprise specializing in lithium iron phosphate batteries, can imagine the demand for Ferrous lithium phosphate. Therefore, on the basis of self-research and self-production, the company also guarantees the supply through the mode of foreign equity participation.

In 2019, the Ecological Environment Bureau of Haidong City, Qinghai Province issued a public notice of environmental impact assessment, and accepted the construction project of Ferrous lithium phosphate with an annual output of 20,000 tons of Qinghai BYD Industrial Co., Ltd., with a total investment of 710 million yuan.

In July 2022, Anda Technology announced that BYD spent 30 million yuan to subscribe for the company’s directional issuance of shares, with a shareholding ratio of 2.11%. In addition, BYD also took a stake in Hunan Yuneng, another leading anode manufacturer in Ferrous lithium phosphate, with a shareholding ratio of 5.27%.

In addition to lithium ore and cathode materials, the company’s annual report revealed that a series of related businesses such as battery aluminum foil, aluminum-plastic film, separator and electrolyte additives were also laid out in the field of power batteries, and the upstream and downstream industries were continuously strengthened.

In 2021, North China Aluminum Company established a battery aluminum foil company, which attracted many battery companies to become shareholders, of which BYD held 2.97%.

Zijiang New Materials is one of the leading enterprises in the domestic aluminum-plastic film industry. In the second half of 2021, strategic investors such as BYD were introduced through capital increase and share expansion, and BYD directly held 3.87% of the shares. At the same time, BYD was the largest customer of Zijiang New Materials.

BYD’s diaphragm layout started as early as 2009, when the company and Foshan Plastic Group Co., Ltd. jointly expanded the lithium-ion battery diaphragm project with a total investment of about 105 million yuan. By August, 2016, BYD’s power battery separator has been partially produced.

In terms of electrolyte additives, in February 2021, BYD took a stake in Huasheng Lithium Battery, which had just been IPO, and held 1.98% of the shares.

2.2 Battery technology and key equipment are independently developed.

Insisting on being long and thin is the development direction of BYD’s battery technology.

The company’s main product, the blade battery, adopts the Ferrous lithium phosphate scheme of long battery cells, flattens the battery cells, and uses the module-free technology to form a battery pack, so that the utilization rate of the internal space is increased to about 60%, and the cost can be reduced by about 25%.

According to TF Securities, in November 2021, Foday battery ranked second in the domestic market share of power battery cells. Foday battery joint venture FAW Foday New Energy Technology Co., Ltd. is mainly engaged in the manufacturing of core components such as new energy batteries, modules and related supporting industries. After the factory is fully put into production, the annual production capacity of power battery can reach 45GWh, which will provide long-life blade batteries for more than 1 million vehicles.

Because the shape of the blade battery is different from that of the traditional power battery, the ready-made standard equipment can’t be used directly. BYD takes advantage of being a "tech man" and the equipment for key processes is developed by itself.

For example, the lamination process adopts the equipment and cutting scheme independently developed by BYD. The pole piece with a length of nearly 1 meter can achieve the accuracy and speed of tolerance control within ±0.3mm and single lamination efficiency of 0.3s/pcs, which is the first in the world. At the same time, self-developed equipment and systems are also used in the assembly and liquid injection.

2.3 layout power battery recycling, trying to solve the demand for raw materials.

In September 2015, BYD and GEM jointly established a recycling system of "material recycling-battery recycling-new energy vehicle manufacturing-power battery recycling". In January 2018, BYD signed a strategic partnership agreement with Tower Company for recycling new energy power batteries. At present, BYD has set up more than 40 power battery recycling service outlets in more than 10 provinces and cities.

In addition to solving the urgent demand for raw materials and reducing the cost of raw materials, another significance of the power battery recycling business is that it may open up a new growth curve for BYD.

Judging from the performance of battery recycling leaders GEM and Tianqi, in 2021, GEM’s power battery recycling business achieved revenue of 151 million yuan, a year-on-year increase of 61.63%; Jiangxi Tianqi Jintaige Cobalt Co., Ltd., the core subsidiary of Tianqi’s lithium battery recycling business, achieved an operating income of 988 million yuan in 2021, a year-on-year increase of 52%; The net profit of returning to the mother was 224 million yuan, a year-on-year increase of 622.58%.

According to the data, the business scope of Taizhou Fudi Battery Co., Ltd., a subsidiary of Fudi Power, includes battery manufacturing and sales, recycling and cascade utilization of waste power batteries in new energy vehicles, and research and development of new materials and technologies. At present, the company is indirectly wholly-owned by BYD Co., Ltd.

2.4 The production capacity continued to expand, adding multiple production bases.

"In 2021, the bottleneck of battery capacity had a certain impact on the mass production of the whole vehicle. With the production capacity of the battery base in 2022, the automobile production capacity will also increase. In April, the proportion of BYD’s loading on the battery side has reached 32.18%, and the gap with Contemporary Amperex Technology Co., Limited is gradually narrowing." The above analyst said.

Since 2021, BYD has successively expanded eight battery production bases in Jinan, Shandong, Wuwei, Anhui, Yancheng, Jiangsu, Wuhan, Hubei, Shaoxing, Zhejiang, Ningbo, Chuzhou, Anhui and Fuzhou, Jiangxi, with a total new production capacity of 205GWh. In 2022, bases in Xiangyang, Hubei and Changchun, Jilin were successively opened, and two base projects in Taizhou, Zhejiang and Nanning, Guangxi were signed.

In terms of production capacity, BYD plans to have a production capacity of 135GWh in 2021 and an available production capacity of 80GWh;; In 2022, the planned production capacity is 285GWh, and the available production capacity exceeds 200GWh;; By 2023, the planned production capacity will exceed 500GWh, and the available production capacity will exceed 350GWh.

The expansion of production capacity has also accelerated the process of BYD’s battery supply.

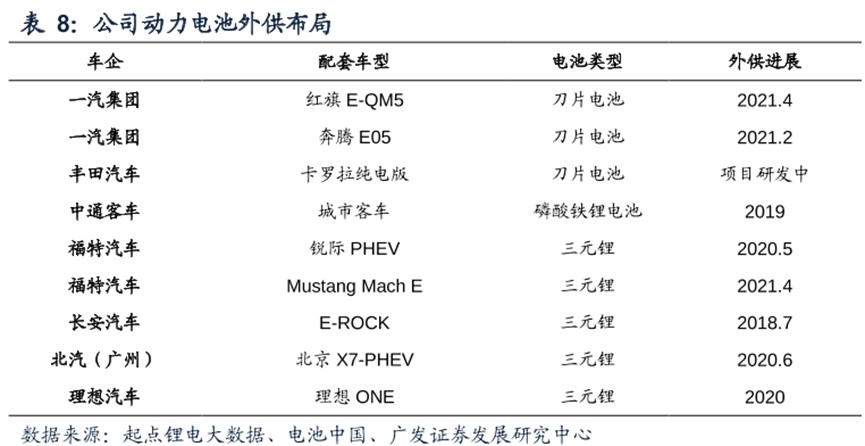

In 2018, BYD Power Battery only had two commercial vehicle customers, Taikai Automobile and Xugong Machinery. In 2019, the external supply of passenger cars was opened, and Changan Automobile, FAW and Changan Ford became new customers.

After BYD launched the blade battery in March 2020, it attracted more car companies to discuss cooperation.

In 2021, the external supply ratio of BYD power battery is about 10%. From the perspective of specific customers, FAW is the first third-party passenger car enterprise to adopt blade batteries, and BYD power batteries account for 25% of its total installed capacity; Dongfeng, Changan and BAIC use ternary batteries, and BYD’s supply accounts for 6%, 4% and 0.1% respectively.

Cinda Securities believes that with the increase of the acceptance of Ferrous lithium phosphate route, the external supply business is expected to usher in a substantial breakthrough, and the power battery business may become another important growth pole of the comparable automobile business.

Third, the conclusion

From about 60 yuan/share in June 2020 to a high of 358.86 yuan/share in June 2022, BYD’s share price has nearly tripled in just two years, which is supported by performance and the result of high valuation given by the market.

It can’t be denied that BYD seems to have opened up the second vein of Ren Du in the past two years, and the vertical integration layout that has been painstakingly managed for many years has soared to generate, resulting in great synergy, forming a virtuous circle of the whole industrial chain of new energy vehicles and constantly gaining positive feedback.

But after the market value once broke through one trillion, where is BYD’s next stop?

There were many optimists. Head brokers use the segment valuation method and think that the company’s reasonable value is 1.4 trillion yuan; There is also a view that new energy vehicles will be not only a means of transportation in the future, but also the next generation of intelligent terminals. If the new energy vehicle industry will produce a company with a market value of 2 to 3 times that of Apple’s stock, the market value of BYD may be trillions of dollars against Tesla.

Real money traders are obviously more rational. The latest market value of BYD’s A-shares has dropped to around 850 billion yuan, and the news that the stock god has reduced its holdings may further return it.

Charles Munger once said, "Wang Chuanfu knows what he can do and what he can’t do, while Musk thinks he can do anything. I prefer to choose those who have self-knowledge. " This is a high evaluation, but obviously, this does not affect Berkshire’s reduction of cash BYD, at the time he thinks it is appropriate.

This article does not constitute any investment advice, and investors should act accordingly at their own risk. The market is risky and investment needs to be cautious.