Rongdong District, xiong’an new area.

Xinhua News Agency reporter Yu Yushe

Xiong’an new area Baiyangdian Tourist Wharf, the cruise ship docked at the shore.

Shi Ziqiang Zhou Bo’s photo report

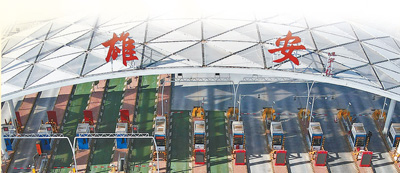

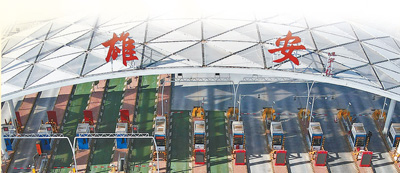

Xiong’an new area Expressway.

Photo by Sun Lijun (image China)

Xiong’an new area started from "a blank sheet of paper" and is now 6 years old.

What does this "city of the future" look like?

"Look! That’s my new home. " Zhai Zong, a new citizen of xiong’an new area, proudly said, pointing to a residential community composed of hundreds of buildings, "It takes 5 minutes to walk to kindergarten, 10 minutes to primary school, 15 minutes to middle school, and 300 meters to walk to the park. This is a city of people. "

"World vision, international standards, China characteristics, high point positioning". Under the personal decision-making, personal deployment and personal promotion of the Supreme Leader General Secretary, a picture of Xiong ‘an in a new era is slowly spreading out in the North China Plain:

"I have never seen such a plan for a city." "I have never seen a new city pay so much attention to the inheritance of excellent traditional culture." "Never seen the ground, underground, ‘ Cloud ’ On ‘ Tri-cities ’ Integrated planning and construction. " "I have never seen such great efforts to control Baiyangdian." "I have never seen the construction of a new city that undertakes the function of Beijing’s non-capital."

Xiong’an new area, the city of the future bearing the Millennium plan and national events, attracts more and more attention from the world.

"I have never seen such a plan for a city."

General Secretary of the Supreme Leader attaches great importance to the planning and construction of xiong’an new area. No matter the concept to be adhered to in planning and the key stage of the planning and preparation process, he personally plans and guides each major issue in time, which provides a fundamental basis for planning from a high starting point and building xiong’an new area with high standards, and points out the direction of work.

"With ‘ Millennium Plan ’ To locate the construction of a new city, which is unprecedented in the history of China city and even the history of the world city. " Duan Jin, an academician of China Academy of Sciences and a professor at the School of Architecture of Southeast University, said, "Planning is the first step in the Millennium. To build xiong’an new area with high standards and high quality, we must first prepare the new district plan with high standards and high quality, so as to achieve world vision, international standards, China characteristics and high-point positioning. "

Plan before you move, plan first. From the preparation of the master plan to the start of construction, and now it has taken shape, planning has played a vital role. Xiong’an new area maintains historical patience and strategic determination, insists on a steady and steady progress, and always promotes planning with high intensity, high density and high quality in the spirit of creating history and pursuing art, so as to "plan every inch of land clearly before starting construction, without leaving historical regrets".

"xiong’an new area is our historical heritage for future generations. We must adhere to the planning, design and construction with the most advanced concepts and world-class standards, which can stand the test of history." Yin Huiliang, executive vice president of Xiong ‘an Research Institute of China Urban Planning and Design Institute, said.

Since the founding of New China, the planning of xiong’an new area has attracted the highest attention, used the largest number of institutions, involved the widest range of fields and gathered the largest number of talents. More than 60 academicians, more than 3,500 experts and technicians participated in the preparation of the new district planning system; In district development and important single buildings, with the support of advanced scientific and technological means, we will integrate advanced concepts such as intelligent management, digital city and green low carbon, and strive to create meticulous and rigorous urban planning and design. "I have never seen such a plan for a city." Many experts who participated in the planning of xiong’an new area felt deeply.

"Never seen a new city pay so much attention to the inheritance of excellent traditional culture"

The key for a new city to stand is to inherit the historical context and pay attention to the protection of historical relics and historical features.

At the beginning of the establishment of xiong’an new area, on May 28th, 2017, Hebei Provincial Bureau of Cultural Relics held a site promotion meeting on the protection of cultural relics and archaeological work in xiong’an new area at Nanyang Site in Rongcheng County. The unveiling of the cultural relics protection and archaeology workstation in xiong’an new area, Hebei Province marks the comprehensive development of cultural relics protection and archaeology in xiong’an new area, Hebei Province.

"Insist on protecting and carrying forward the excellent Chinese traditional culture and continuing the historical context", the cultural relics department of Hebei Province implements the spirit of the important instructions of the Supreme Leader General Secretary, and comprehensively promotes the cultural relics protection and archaeological work in xiong’an new area, Hebei Province with the goal of serving the overall situation of Xiong ‘an economic construction and interpreting Xiong ‘an’s Millennium history and culture.

In recent years, the cultural relics department has successively carried out archaeological investigations and surveys in xiong’an new area, Nanyang site in Rongcheng, Mianzhou site in Xiongxian, Guzhou site, environmental archaeology in Xiong ‘an, Baiyangdian and the Great Wall in Yannan. A total of 28 archaeological investigations, explorations and excavations were carried out, with an exploration area of 3.45 million square meters and an excavation area of 10,555 square meters. 277 ancient tombs of various periods were cleared and 809 cultural relics were unearthed. He has achieved fruitful results in urban archaeology in Hebei, prehistoric archaeology in Baobei area, environmental archaeology in Baiyangdian area, and historical and cultural research on the Song-Liao border.

Nanyang Site, Nanyang Village, Rongcheng County, is the largest national key cultural protection unit in xiong’an new area. Shortly after the establishment of xiong’an new area, a high-standard joint archaeological team organized by National Cultural Heritage Administration was welcomed here.

Adhering to the awe of historical relics, the archaeological team carried out an archaeological investigation of more than 40 square kilometers and found the settlement group of "Da Nanyang" sites with Nanyang site and Liangmatai site as the core. The cultural relics continued from the late Neolithic Age to the Song and Jin Dynasties, and the cultural development lasted for nearly 3,000 years.

A series of important archaeological discoveries have constructed the space-time framework of Xiong ‘an’s Millennium history and culture, made important contributions to the research, protection and inheritance of xiong’an new area’s cultural heritage, and created a win-win situation for the planning and construction of the new district and the inheritance of history and culture. Zheng Zhanfeng, technical consultant of China Xiong ‘an Group Ecological Construction Investment Co., Ltd. said: "I have never seen a new city pay so much attention to the inheritance of excellent traditional culture."

Xiong’an new area attaches great importance to the protection of historical and cultural heritage, and has made useful explorations to improve the system of "archaeological pre-placement of land storage". Since 2021, archaeological exploration and excavation have been carried out in the starting area, and 35 archaeological explorations have been completed, including Bailong Site, with an exploration area of 1.007 million square meters; Thirteen archaeological excavations, including the Wufang site, were started, and more than 1,500 sets of pottery, copper and other relics were unearthed.

Avoid a thousand cities and make a demonstration to solve the "big city disease". "In the planning and construction of the new district, adhere to ‘ Culture casts the soul of the city ’ The concept of urban construction, spatial layout has changed the previous single center ‘ Spread the pie ’ Type development model, the implementation of group development. The groups are relatively concentrated, distinctive, closely linked and complementary in functions, which organically connects production, life, education and medical care, and achieves a balance between entrepreneurial employment and residential functions. " Wang Zhigang, Director of xiong’an new area Natural Resources and Planning Bureau, introduced.

Yuerong Park, which covers an area of about 160 hectares, is designed by top landscape experts in China, and each beam and column is carefully selected. Walking into the gate of the park, from Shang and Zhou Dynasties to Han and Tang Dynasties, the scenery of architectural civilization in different periods is gathered, which seems to unfold a historical picture of Chinese civilization.

"Never seen the ground, underground, ‘ Cloud ’ On ‘ Tri-cities ’ Integrated planning and construction "

Xiong’an new area has built supporting infrastructure with high standards, and "Xiong ‘an Quality" runs through all fields and the whole process of construction. The key projects built by Seiko will become a symbolic existence after completion. "Never seen the ground, underground, ‘ Cloud ’ On ‘ Tri-cities ’ Integrated planning and construction. " Cui Wenfei, deputy director of xiong’an new area Construction Headquarters Office, said.

Open the regional communication artery. Rail transit will become an important mode of transportation connection between groups in the new district and an important part of public transportation and green transportation in the new district. High-speed railway station, the largest Xiong ‘an in Asia, was completed and put into use by the end of 2020. Starting from Beijing West Railway Station, the high-speed train takes one hour to reach Xiong ‘an Station. According to reports, Jingxiong, Rongwu New Line, Jingde Phase I Expressway, Easy Line and Anda Line have been completed and put into use, and more than 500 kilometers of regional traffic arteries have been opened.

Pay attention to the construction of underground pipe network. Adhere to the synchronous planning of the ground and underground, and build underground before the ground. xiong’an new area will first build an underground utility tunnel, which will promote the construction of urban infrastructure such as water, electricity, heating and gas and share a unified underground space. The underground utility tunnel in Rongdong area is 14.8km long and was completed and put into use in July 2021. The pipe gallery is divided into two floors, including a gas tank and a comprehensive water tank. The cabin is equipped with temperature and humidity sensors, combustible gas detectors, couplers, etc., and 1071 cameras are arranged along the line for 24-hour monitoring. The "Xiong ‘an Plan" for the underground utility tunnel is the first time to centrally plan and construct municipal infrastructure such as utility tunnel and underground pipelines, so as to make efficient use of underground space. According to estimates, this move saves 7% of the construction land area and reduces investment by 12%; The corridor saves more than 20% space and 18% investment. "For the first time in China, xiong’an new area has built an IoT-aware network system covering all pipe corridors, and its management is more intelligent and efficient." Zhang Yaodong, Party Secretary and Chairman of Xiong ‘an Group Infrastructure Co., Ltd. said.

Building a leading digital city. From smart street lamps and smart manhole covers to smart construction sites and smart transportation … … Xiong’an new area shows the innate "wisdom gene" everywhere. On Wenying West Road in Rongdong District, the lamppost is equipped with "sharp tools" such as camera and laser radar RSU (roadside unit). Li Jianyong, a staff member of China Telecom Digital City Technology Co., Ltd., said: "It is a multi-functional smart light pole, with a total of 153 kilometers in the main and secondary roads of Rongdong. As far as the unmanned scene is concerned, the light pole equipment collects road information and sends it to the vehicle-mounted system to realize vehicle-road coordination. " At present, xiong’an new area has set up the basic framework of a smart city with "one center and four platforms" as the core, and the physical building and virtual data can grow together. At the end of 2022, Xiong ‘an City Computing Center was officially put into operation, and xiong’an new area’s "Urban Brain" began to operate, providing network, computing and storage services for "Digital Xiong ‘an" big data, blockchain and Internet of Things, and providing important support for building "Xiong ‘an on the Cloud". In addition, xiong’an new area is the first city in China with intelligent transportation layout, with about 200,000 sensors per square kilometer, which makes the whole city "alert" through the connection of 5G Internet.

"Never seen such great efforts to control Baiyangdian"

Golden reeds sway in the wind, and trees not far away take out green buds … … Baiyangdian Lake in early spring is full of blue waves and vitality.

"The water is clearer and the environment is more and more beautiful!" Walking on the wooden plank road beside the lake, Tian Genshuang, a villager from Dongdiantou Village, Anxin County, xiong’an new area, couldn’t help feeling, "I have never seen such a great effort to control Baiyangdian!"

"Don’t let a drop of sewage flow into Baiyangdian!" Since the establishment of xiong’an new area, Baiyangdian Lake has ushered in the largest systematic ecological management in history. Hebei province’s "one chess game" is linked up and down, and the Baiyangdian ecological restoration project is implemented with high standards and strict requirements. In 2021, the water quality of Baiyangdian will be comprehensively upgraded from Grade V in 2017 to Grade III, and it will step into the ranks of good lakes in the country. The metabolic function of "Kidney of North China" is recovering at a speed visible to the naked eye.

Baiyangdian Lake is located at the "lower tip of nine rivers" in Daqing River Basin, and it is the key to improve water quality to keep the upstream water "into the gateway". 94% of the upper reaches of Baiyangdian Lake are in Baoding, and the whole area of Baoding belongs to the upper reaches of Baiyangdian Lake. Since 2017, Baoding City has continuously carried out river and lake cleaning operations, removing more than 11 million cubic meters of various river wastes and blocking 2024 sewage outlets into the river; By scientifically dispatching reservoir water and actively coordinating the South-to-North Water Transfer Project, Baiyangdian Lake will be ecologically replenished.

Adhere to systematic management and coordinated management, and promote comprehensive management of the whole basin, upstream and downstream, left and right banks, and inside and outside the lake. Hebei Province co-ordinates the implementation of 66 treatment projects in nine categories, including industrial, urban, agricultural and rural areas and lake areas, ecological restoration, river regulation and ecological water replenishment, and promotes the leap-forward improvement of Baiyangdian water quality with the strongest measures. In April 2021, the Regulations on the Control and Protection of Baiyangdian Ecological Environment came into effect, which made a systematic and comprehensive regulation of Baiyangdian and its watershed.

Xiongxian, the largest plastic packaging and printing base in the north with an annual output value of over 10 billion yuan, completely shut down and banned heavily polluting enterprises involving waste plastics and printing. Gaoyang County, Baoding City, adjacent to xiong’an new area, is a famous textile town in China, and three seasonal rivers flow into Baiyangdian Lake. In order to solve the pollution problem of printing and dyeing wastewater, in recent years, the county sewage treatment plant has been continuously expanded and upgraded, and now it has become the largest county-level sewage treatment plant in Hebei Province.

From "less water, inferior water" in the past to "good water" now, the ecological environment management and water quality of Baiyangdian have undergone historic changes, and the function of "kidney of North China" has been accelerated. "There is water, good water, but also water conservation. We must constantly raise the awareness of water conservation in the whole society and strive to build a water-saving model city." Wu Haimei, deputy director of xiong’an new area Bureau of Ecology and Environment, said.

Last year’s Implementation Plan of xiong’an new area on Promoting Water Conservation from a High Starting Point put forward 26 water-saving indicators in four aspects: comprehensive indicators, industry indicators, management indicators, public awareness and satisfaction with water conservation, and deployed 23 tasks in six aspects: implementing water-saving management system, innovating water-saving incentive and restraint mechanism, carrying out water-saving infrastructure, implementing urban water conservation and loss reduction, implementing industrial water conservation and emission reduction, and implementing agricultural water conservation and efficiency improvement, and made clear provisions on strengthening organizational guarantee, institutional guarantee and financial guarantee.

Xiong’an new area shoulders the historical mission of building a model city of ecological civilization in the new era, and residents’ awareness of ecological protection is constantly improving. For example, xiong’an new area adopts the management mode of "government+non-governmental associations+volunteers" to mobilize all social forces to love and protect birds. In some Dianzhong villages, bird hunters in the past destroyed bird nets at home and turned into folk bird protection volunteers.

"In the past, some people picked up birds’ eggs, trawled for fishing and electric fish in Baiyangdian Lake, but now they are basically gone." Han Zhanqiao, a teacher of Tongkou Primary School in Anxin County and a volunteer of bird protection, felt obviously. He also wrote the song "I am a bird in Xiong ‘an" to express his joy at the restoration of Baiyangdian’s beautiful scenery of "lotus red reed green, birds flying together".

According to statistics, up to now, there are 252 species of wild birds in Baiyangdian, 46 species more than before the establishment of xiong’an new area. According to the monitoring of Hebei Academy of Marine and Fishery Sciences, there are 46 species of fish in Baiyangdian Lake, and indigenous fish such as pomfret, herring and whitebait have reappeared in Baiyangdian Lake, 19 species more than before the establishment of xiong’an new area, and the biodiversity of fish in Baiyangdian Lake has reached a high level.

Before large-scale urban construction, xiong’an new area took the lead in ecological infrastructure construction and environmental improvement.

The Millennium plan begins with the Millennium Xiulin, fully respecting nature, conforming to nature and protecting nature. With the goal of building a national forest city demonstration area, xiong’an new area has carried out afforestation and land greening on a large scale, laying a good ecological background for the planning and construction of the new area. At the same time, most of the seedlings are native trees suitable for the local environment, and the nature of plants should be respected in order to better take root. Different tree ages and heights are scattered, and then different varieties are mixed together, so that artificial forests can evolve into natural forests more quickly. "Xiulin, Green Valley and Dianwan" constitute the ecological space skeleton of xiong’an new area’s starting area. "It is connected to the northern forest belt in the north and Dianwan District in the south, and will soon become a big park intertwined with blue and green." Zheng Zhanfeng introduced.

300 meters into the park, 1 km into the forest belt, and 3 km into the forest. In recent years, xiong’an new area has accumulated more than 470,000 mu of afforestation, forming an ecological spatial pattern of "one lake, three belts, nine patches and multiple corridors". At the same time, a number of high-quality gardens such as "Millennium Xiulin", Yuerong Park and Jinhu Park have become green landscapes in the new district. An ecological picture of blue-green interweaving, fresh and bright, and harmonious water city is spreading.

"I have never seen the construction of a new city to undertake the function of Beijing’s non-capital"

It is the initial intention to set up xiong’an new area to build a centralized bearing place for Beijing’s non-capital functions.

On February 23, 2017, when General Secretary of the Supreme Leader made a field trip in Anxin County and presided over the symposium on planning and construction of xiong’an new area, Hebei Province, he pointed out that planning and construction of xiong’an new area is a strategic choice with great historical significance and a historic project to relieve Beijing’s non-capital function and promote the coordinated development of Beijing, Tianjin and Hebei.

"The focus and starting point is to move a surgical operation to relieve the function of Beijing as a non-capital city and solve the problem of ‘ Big city disease ’ Problem. " General Secretary of the Supreme Leader has worked out a big idea for the coordinated development of Beijing-Tianjin-Hebei.

From planning the coordinated development strategy of Beijing-Tianjin-Hebei, to proposing to choose a centralized bearing place for relieving Beijing’s non-capital functions, and then deploying the construction of xiong’an new area, General Secretary of the Supreme Leader focused on the overall situation, strategized and directed the pulse.

In the past six years, from the completion of the top-level design to the large-scale substantive construction in xiong’an new area, and then to the simultaneous promotion of Beijing’s non-capital function and construction, a beautiful picture of high-quality development has slowly unfolded.

The first batch of landmark relief projects were successively built in xiong’an new area. The main structure of China starnet headquarters project was capped, the construction of China Sinochem and China Huaneng headquarters projects was accelerated, and China Mineral Resources Group registered in the new district and completed the location of its headquarters. The first batch of 4 universities and 2 hospitals were selected. The projects of kindergartens, primary schools and middle schools supported by Beijing in a turnkey way have been completed and handed over to the new district, and the central enterprises have set up more than 140 institutions in the new district.

A number of market-oriented relief projects are also progressing in an orderly manner. On November 23rd, 2022, the unveiling and launching ceremony of China Railway Industrial Cluster was held in xiong’an new area, which was the first central enterprise industrial cluster in xiong’an new area.

Xiong’an new area’s construction is racing against time and speeding up in an all-round way. The "four horizontal and ten vertical" backbone road network in the starting area has been fully started, and the "three horizontal and four vertical" backbone road network in the starting area is open to traffic.

The construction site of China Sinochem 001 Building Project is in full swing. In the foundation pit with a diameter of nearly 100 meters, 56 steel structure columns have been erected. As the future headquarters base of China Sinochem Holding Co., Ltd., the 001 building project is expected to be completed by December 31st next year. Upon completion, the building will become the tallest landmark building in xiong’an new area, which can meet the requirements of 1000— Office needs of 1200 employees.

In xiong’an new area high-speed railway station hub area, CCCC Future Science and Technology Innovation City, tall buildings are magnificent. Ren Xiaozhen, general manager of CCCC Xiong ‘an Industrial Development Co., Ltd. said that the total construction area of Kechuang City is 1.4 million square meters, and its main function is to undertake large and medium-sized enterprises and research institutes in Beijing. At present, there are more than 270 enterprises interested in signing contracts, among which smart transportation enterprises account for about 50%.

Beijing Eye Technology Co., Ltd. is one of the first 12 enterprises in Zhongguancun, Beijing to sign a strategic cooperation agreement with xiong’an new area. "The company has identification technologies such as face, iris and finger vein, which is highly compatible with the innovation-driven development orientation of the new district." Zhang Hui, the company’s brand marketing director, said, "Since it settled in xiong’an new area in 2018, the company has landed more than 30 intelligent scenarios, added more than 200 patents, and newly participated in the revision of 59 national and industry standards."

"I have never seen the construction of a new city that undertakes the function of Beijing’s non-capital." Ding Jinjun, deputy director of the Reform and Development Bureau of xiong’an new area, said, "As the new ‘ Two wings ’ First, xiong’an new area must find its own coordinates in the overall situation of relieving Beijing’s non-capital function and promoting the coordinated development of Beijing, Tianjin and Hebei, strive to create a first-class business environment with marketization, rule of law and internationalization, and create ‘ Xiong’ an service ’ Brand. "

When the law returns to spring, everything will be renewed. Under the strong leadership of the CPC Central Committee with the Supreme Leader as the core, we will fully implement the spirit of the 20th Party Congress, adhere to the great historical outlook, maintain historical patience, work one after another, year after year, ensure a blueprint to the end, and strive to create "Xiongan quality". xiong’an new area is striving to create a national model of high-quality development.

New journey, new spring. City of the future, accelerate to the future!