Wen | Gather beautiful poems

Edit | Wood

In recent years, consumers are pursuing the trend of natural, healthy and additive-free products. Therefore, some brands began to focus on the concept of "no added preservatives" to attract consumers, while others began to seek a "new anti-corrosion system" with better performance.

According to the Technical Specification for Cosmetic Safety (2015 edition), 51 kinds of preservatives are allowed to be used in cosmetics in China, which are mainly divided into five categories: formaldehyde and its releaser, ester of p-hydroxybenzoic acid, isothiazolinone, alcohol and acid. Common ones are phenoxyethanol, nipagin esters, formaldehyde releaser preservatives, CMIT/MIT (Casson) and IPBC.

Cosmetic preservatives, also known as "traditional preservatives", are often considered as one of the main allergens in cosmetics. According to the survey, about 6% consumers are sensitive to preservatives and spices in cosmetics. In addition, preservatives also have the characteristics of biological toxicity, which is irritating to the skin and may disturb the endocrine system of the human body.

Therefore, domestic and foreign brands are claiming "no added preservatives". For example, Fancl Fangke, which is famous for its "no additive", is mainly used in 1,2-pentanediol+small package or seal to achieve anti-corrosion. There are also Japanese brands such as HABA and NOMAMA, all of which claim not to use preservatives such as benzoate and other chemical additives and spices that are easy to irritate the skin.

In 2009, based on the brand’s patented packaging technology, D.E.F.I aseptic chamber, Yayang also launched a series of soothing and intensive care products without corrosion. It is understood that this series of products can be completely sealed in packaging, and the number of ingredients used is less than 7, mainly composed of water, oils, plant extracts, emulsifiers and thickeners. The ingredient list does not contain preservatives and preservative-like ingredients.

In fact, preservatives are an important component to deal with microbial contamination in personal care products. Preservatives themselves have the characteristics of "preventing microbial growth" and "inhibiting bacteria", which determines that cosmetics can be preserved for a long time and is of great significance for ensuring product safety.

During the spot check of cosmetics by the Food and Drug Administration, "the total number of colonies exceeds the standard" has always been the "hardest hit" for cosmetics companies to step on thunder frequently. In 2020, National Medical Products Administration reported 207 batches of unqualified cosmetics, among which 192 batches of unqualified products were concentrated in two categories: "label identification" and "cosmetic microbial indicators".

In 2021, the Technical Guidelines for Cosmetic Safety Assessment issued by National Medical Products Administration clearly pointed out: "For cosmetics in the research and development stage, the effectiveness of its anti-corrosion system can be evaluated with reference to internationally accepted standards or methods." This shows that the effectiveness evaluation of cosmetic preservative system is the only way before the product goes on the market.

It is worth mentioning that at present, cosmetic preservative systems at home and abroad are evaluated according to microbial challenge test. However, this test only specifies the selection scope of test strains, and there is no unified and clear evaluation standard for anticorrosion efficiency among countries.

So, how do cosmetics achieve "no added preservatives"? In fact, most products on the market that claim to have no additives mainly adopt two methods: one is to add antibacterial ingredients other than preservatives for cosmetics, so as not to contain preservatives in the traditional sense; The other is to meet the product standards without adding preservatives in formula dosage form (such as pure oil formula, solid formula, etc.) and packaging form (such as vacuum packaging and secondary throwing form, etc.).

Although there are still many unresolved difficulties in developing an effective and safe anti-corrosion system, the state has been strengthening the regulatory constraints. Some time ago, it was reported by the media that some cosmetics were rejected because they did not see/add preservatives, and the innovative way of anti-corrosion system that met the regulatory requirements also caused heated discussion in the industry.

In terms of the safety of preservatives, the permitted preservatives for cosmetics all have their own usage concentration and usage restrictions. Moreover, most of them have a long history of application and have clear data and advanced safety risk assessment, such as commonly used preservatives such as phenoxyethanol and nipagin esters.

"There is a big misunderstanding about the safety of preservatives in the market. In the INCI catalogue, the safe dosage of ingredients has been indicated. For example, butanediol mainly plays the role of solvent and humectant in cosmetics, and high-content alcohol has the effect of inhibiting microbial reproduction. If the formula contains 15% butanediol as a solvent and it is unsafe as an antiseptic and bacteriostatic ingredient, it is obviously wrong. " General Manager of Guangzhou Aizhuo Biotechnology Co., Ltd.Zhang JunSaid.

What are the innovative directions of anti-corrosion system?

As an ideal anti-corrosion system, it should first have the ability to destroy a variety of microorganisms, that is, it has broad-spectrum activity and can take effect on gram-negative bacteria, gram-positive bacteria, yeast and mold. From this point of view, it is almost impossible for a single preservative to achieve comprehensive safety and antibacterial effect.

Zhihu’s "Cosmetic Theory" once listed five principles for the establishment of preservatives: good compatibility, good safety, good water solubility, stability and broad-spectrum antibacterial activity.

In order to find more ingredients with antiseptic effect, the cosmetics industry is also promoting the innovation of antiseptic system, and a "new antiseptic system" composed of non-traditional antibacterial ingredients is emerging.

Zhang JunSaid: "Strictly speaking, the new anti-corrosion system is mainly composed of a class of ingredients with antibacterial effect, such as alcohols and antioxidants, so it can not be called preservatives, and they are also essentially different from the in-table preservatives stipulated in the Technical Specification."

1) Reasonable compatibility of antibacterial components with traditional preservatives

It is understood that the new anti-corrosion system, which is widely used at present, usually contains polyol (such as pentanediol, hexanediol, octanediol, etc.), organic acid (octanoyl hydroxamic acid, etc.), ketone (p-hydroxyacetophenone, etc.) and other components. Most of them are multifunctional auxiliary ingredients, which not only have antibacterial and synergistic effects, but also have the functions of moisturizing, antioxidation, chelating, conditioning and dissolution.

Compared with traditional preservatives, these antibacterial components are usually difficult to carry the "big flag" of the anti-corrosion system alone in the formula because of their relatively weak anti-corrosion effect and insufficient safety data and compatibility data. Therefore, it is necessary to cooperate with all components of each formula for analysis.

Because different preservatives and antibacterial components have their own advantages and disadvantages, they can learn from each other by compounding. For example, compounding antibacterial components with traditional preservatives, or scientific compatibility between antibacterial components, can not only expand the antibacterial spectrum from different mechanisms of action, synergize and avoid the formation of drug-resistant bacteria; But also can reduce the dosage of a single component, which is more conducive to ensuring safety.

"At present, the product protection function of the formula system can be better provided through the synergistic components. Combining some ingredients with microbial inhibition ability through reasonable dosage and formula can provide a more reliable and mild product protection ability for the product system. Compared with the traditional anti-corrosion system, this new combination of ingredients is more advanced in gentleness and safety, which solves the shortcomings of the traditional anti-corrosion system in practical application. " Lao Shuquan, director of China District of Dezhixin Cosmetic Raw Materials Department, said.

Diatomic alcohol+p-hydroxyacetophenone is a common anti-corrosion substitution system, which has been applied to many star items launched by domestic brands. For example, Winona’s soothing and moisturizing essence uses 1,2- pentanediol, which is matched with p-hydroxyacetophenone to coordinate the antibacterial effect; The form of 1,2- pentanediol +1,2- hexanediol+p-hydroxyacetophenone is used in the essence of Baizucui "Little Green Bottle".

△ Winona Soothing and Moisturizing Special Care Essence (left), Baizhu Soothing and Repairing Essence (right)

2) Plant extracts can be used as natural substitutes for preservatives?

In addition to the compatibility of ingredients, the innovative direction of anti-corrosion system is gradually moving closer to the direction of plant extracts from chemicals. The essential oil extracted from many plants in nature (such as mint, perilla, clove, Ferula, pepper, etc.) will contain natural antiseptic and antibacterial substances, so it is not the raw material company that calls such plant extracts "plant preservatives".

Most people in the industry still hold a wait-and-see attitude towards the antiseptic effect of plant extracts. Generally speaking, most plant extracts have poor antiseptic effect, and have special odor, which is difficult to disperse in water and compatibility.

In addition, due to the complexity of plant sources, many plant extracts are unknown in composition, mechanism and safety data. In 2020, the plant preservative Euro-Napce (Qinjiao fruit extract, Pulsatilla chinensis extract and Ustilaginella tamarense extract) developed by Korea C&B Company was exposed to the harmful substance "silver cyanide", and the safety of "plant preservative" also attracted great attention.

Lao Shuquan bluntly said: "At present, there is still no fully mature so-called plant preservative scheme system accepted by the vast market. The plant preservative system is mainly faced with challenges such as gentleness, water solubility, odor, color, stability, safety and reliability, and it is still very immature. "

In this regard,Zhang JunIt is considered that "plant preservatives are a market trend, but there is a high technical threshold for’ plant preservatives’ at present. First of all, the cost of plant preservation is high, especially for washing and care products; Secondly, plant ingredients have certain defects in terms of odor and color, and the requirements for formula design will be higher. "

However, he affirmed the application prospect of plant antibacterial components: "Since many plants have antibacterial and anti-inflammatory effects, some of them must have antibacterial effects. Further analysis of the components in each plant can develop plant antibacterial agents that meet the requirements of the formula."

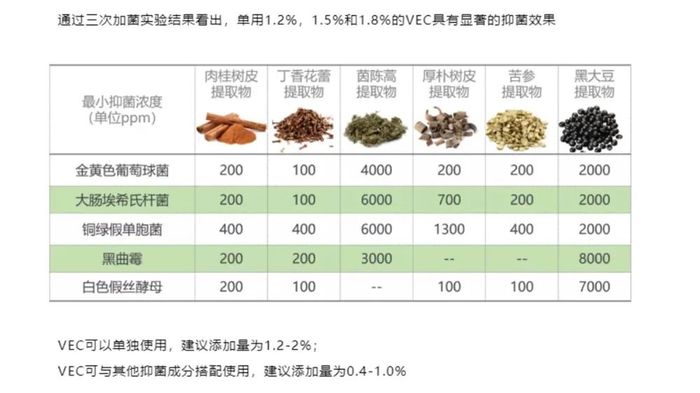

Azhuo Bio has introduced "V series" plant extract bacteriostatic agents represented by NAGOVEC and NAGOVAC, which are mainly composed of several plant extracts with antibacterial effects.

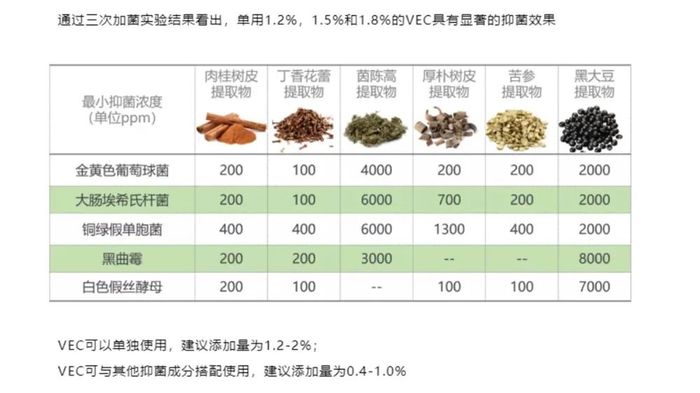

Take NAGOVEC as an example, which includes magnolia bark extract, clove bud extract, Artemisia capillaris extract, cinnamon bark extract, Sophora flavescens extract and soybean extract. After verification, the raw material has obvious bacteriostatic effect on Burkholderia cepacia, pseudomonas putida, Staphylococcus aureus, Aspergillus niger, Candida albicans, Escherichia coli, Pseudomonas aeruginosa and other strains.

△NAGOVEC

3) Can food preservatives bring new inspiration?

In addition, the development of food preservatives also has some inspiration for the innovation of cosmetic preservative system. Many food preservatives have been widely used in personal care products, such as benzoate. Relevant data show that the number of personal care products containing benzoate is increasing at an annual rate of 7%.

Cetylpyridine chloride (CPC), another food preservative, has also expanded its application in the field of personal care. The antibacterial component is mainly used in mouthwash, toothpaste, oral spray and other products, and it is effective for most microorganisms except Aspergillus fungi, but it has not been officially listed in the annex of the list of cosmetics preservatives approved in Europe.

According to foreign media reports, Colijn, a supplier of cosmetic raw materials, once planned to use food preservatives as an alternative to parabens. The food preservatives they studied mainly include benzoic acid, benzyl alcohol and potassium sorbate, among which potassium sorbate is widely used to inhibit molds and yeasts in foods such as cheese, yogurt and cider.

Scientific research is the main driving force for the innovation of anti-corrosion system

Under the guidance of market trends and regulatory regulations, the construction of anti-corrosion system needs to meet more requirements and restrictions. In addition, there are many problems in scientific research of anti-corrosion system.

From the point of view of action mechanism, preservatives mainly change the permeability of micro-biofilm system, change the properties of protein or inhibit the activity of enzymes, reduce the metabolism of microorganisms, and make its metabolites unable to be transported out, thus achieving the purpose of interfering its growth and reproduction [1].

This inhibition of microorganisms also makes preservatives violate the concept of "skin microecology" in personal care products. The balance of skin microecology is very important for maintaining a healthy skin condition. However, preservatives in cosmetics may change the micro-ecological environment of the skin and affect the pH value, oil secretion and metabolic ability of the skin.

Although many literatures have done relevant experiments on this topic, there is no clear conclusion at present, and the effects of different antiseptic systems on skin microecology are also very different.

Studies have shown that the mixture of diazolidinyl urea and IPBC, methyl nipagin, etc. in cosmetics can inhibit and disturb the resident flora of skin to some extent [2-3]. However, low concentrations of phenoxyethanol, methyl nipagin and propyl nipagin have also been proved to prevent cosmetics from bacterial contamination, and at the same time, it will not affect the skin microecological balance [4].

The specific effects of preservatives on skin microecology are still being explored. Why do some preservatives have stronger affinity for bacteria than fungi? What are the physical and chemical characteristics of microbicidal components? Because the skin microbiome is too large, there is no clear answer to these questions.

In addition, the antiseptic system plays an important role in the formulation design, which directly determines the storage period of cosmetics, so many factors need to be considered.

Lao Shuquan said: "To design a product formula protection system that meets the requirements, there are many issues that need to be considered. Whether the applicable population of the formula involves special populations (such as infants and pregnant women, etc.), and at the same time, we must also consider the differentiation of formula dosage forms and the combination of as many kinds of low doses as possible to reduce some negative factors (such as gentleness, stability, and microbial resistant strains) brought about by high-dose addition of a single type."

Therefore, the root of promoting the innovation of preservatives lies in scientific research. Only by further studying the interaction between microbiota and preservatives and linking preservative science with different research fields can we develop a safer and more effective preservative system.

"In the future, the two innovative directions of preservatives should be plant extracts and fermented antibacterial peptides. Plant extracts contain many antibacterial components, which are in line with the market trend of green, environmental protection and health, and can also show the advantages of traditional plant resources in China; Antimicrobial peptides are less irritating to mucous membranes and are more suitable for special use scenarios. "Zhang JunSaid.

The construction process of new anti-corrosion system puts forward a great test for formula design. Although there is still a long way to explore the new anti-corrosion system in terms of raw material cost and safety data. However, there are still many brands and raw material companies that realize the synergistic collocation of ingredients and compositions through different technical means, thus breaking through the traditional model and creating a modern product protection system.

With the advancement of scientific research, the innovation direction of anti-corrosion system will be clearer, and the choice of preservatives will have more possibilities.

References: [1] Cheng Wenjing, Zhang Jiachan, Yang Yilin, et al. Investigation on the use of preservatives in skin care products in the market and exploration on the future development trend [J]. Daily Chemical Industry, 2021, 51(7):7.

[2] Chen Guanwu. Study on the inhibitory effect of Gemma BP on resident bacteria in the surface layer of skin 1. Journal of Environment and Health, 2012,29 (7): 615-616.

[3] Cai Ying. Inhibitory effect of methyl nipagin on skin resident bacteria. Modern Preventive Medicine, 2013,40 (9): 1726-1727.

[4] Lalitha, C. and Rao, P.V.V.P. Antimicrobial Efficacy of Preservativesused in Skin Care Products on Skin Micro Biota. International Journalof Science and Research. 2013, 6: 14

Information source: makeup theory, little K formulator, Jung personal care, China cosmetics.