From June 1st, tax invoices can be delivered home free of charge without queuing.

Every time you get a ticket, you have to go to the tax service hall.

The journey takes a long time.

Also bring the tax controller, ID card and special seal for invoice.

It’s easy to leave things behind if you’re not careful

Now these troubles can be solved.

Since June 1, 2020

Beijing Economic Development Zone Taxation Bureau

It will be a normal ticket-using enterprise in the region.

Provide through the "e-ticket delivery" mode

Free mail delivery service for receiving invoices

Yifen

How to operate this "ticket e delivery"?

Xiaoye

Xiaoye has prepared a detailed tutorial for everyone. Let’s take a look!

Detailed operation manual of "ticket e delivery"

"Ticket e-delivery" is a convenient service project of online invoice collection launched by logistics service unit entrusted by Beijing Taxation Bureau of State Taxation Administration of The People’s Republic of China. It aims to solve the problems of long journey, long time-consuming and difficult queuing for taxpayers to go to the tax service hall, and realizes the one-stop invoice collection service of "online application of taxpayers, automatic processing on cloud platform, and limited logistics delivery to the door".

one

"e-ticket delivery" feature

1. All year round, 365*24 hours service;

2. Express delivery to your door within 24 hours;

3. Coverage of the whole city, which can be delivered in Beijing area;

4. tax express through train, unlimited number of non-traffic jams;

5. Professional support team, 24-hour service hotline 4006289911 to provide follow-up guarantee;

two

Ticket e delivery qualification requirements

1. The tax registration status is business;

2. VAT taxpayers (except taxpayers who declare VAT on a per-time basis and general VAT taxpayers during the counseling period);

3. It has been included in the upgraded version of the VAT invoice system;

4. There is no internal investigation information about invoices;

three

Ticket e delivery invoice type

Five categories and seven versions of invoices can be applied for online: "two-copy and five-copy versions of general VAT invoices, three-copy and six-copy versions of special VAT invoices in Chinese, unified invoices for motor vehicle sales (computer version), roll-type invoices for taxi passengers and electronic general VAT invoices".

four

Application for online ticket collection qualification

1. Taxpayers log in to State Taxation Administration of The People’s Republic of China Beijing Electronic Taxation Bureau.

2. Click Login, enter State Taxation Administration of The People’s Republic of China Beijing Electronic Taxation Bureau, and click the "Invoice Use" module under the "I want to do tax" directory.

3. Taxpayers enter the "invoice collection" and click the "invoice distribution (e-delivery)" button to enter the "e-delivery" qualification application page (note: if you are qualified to apply for invoices online, you will directly enter the invoice application page, otherwise you will enter the online invoice application qualification application page).

4. You need to submit a qualification application for the first use. Fill in the real contact person and mobile phone number, and confirm that "our company (or individual) confirms to voluntarily use the" ticket e-delivery "service", and click the submit application button.

five

Steps to apply for invoices online

1. Taxpayers enter State Taxation Administration of The People’s Republic of China Beijing Electronic Taxation Bureau;

2. Select "Invoice Business" in the navigation bar and click "Invoice Distribution (Ticket E Delivery)" to enter the "Ticket E Delivery" page;

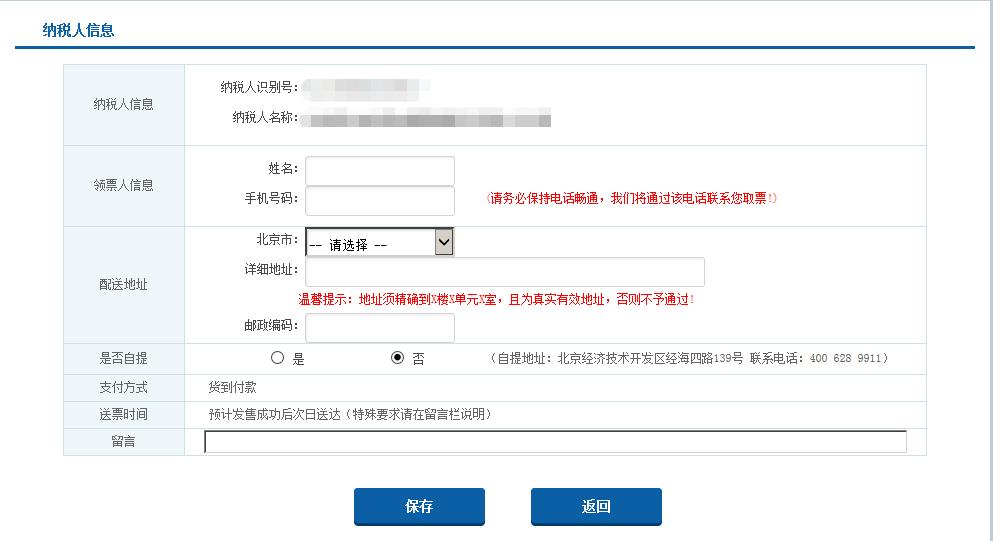

Step 3 fill in the application form

Enter the invoice application page and click the "New Application" button on the right side of the page.

Note: This button will only appear after the last invoice application order has been accepted successfully.

The application form is as follows. You need to fill in the number of applications, the name of the ticket holder, the mobile phone number, the location, the detailed address and the postal code. Among them, the number of applications must be an integer multiple of 5 and cannot be greater than the number of applications.

After filling out the application form, click the "Save" button. The table can be modified before it is submitted again.

4. Submit the application form

Please submit this application form when you are sure that the information filled in is correct. ("Submit" button in the action bar of the list page) After the submission is successful, please wait for the tax authorities to accept your application.

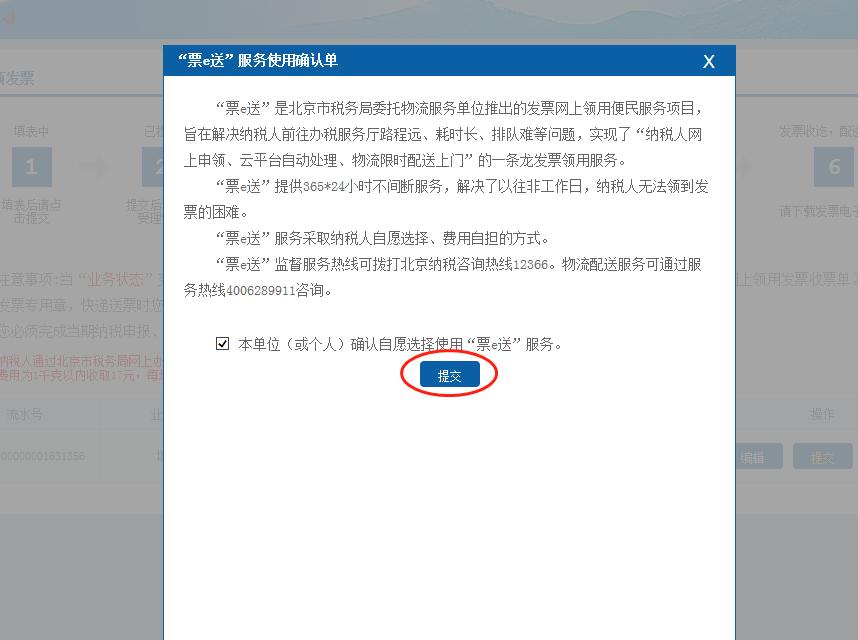

When submitting, you need to check the "Ticket E Delivery" service use confirmation form, otherwise it cannot be submitted.

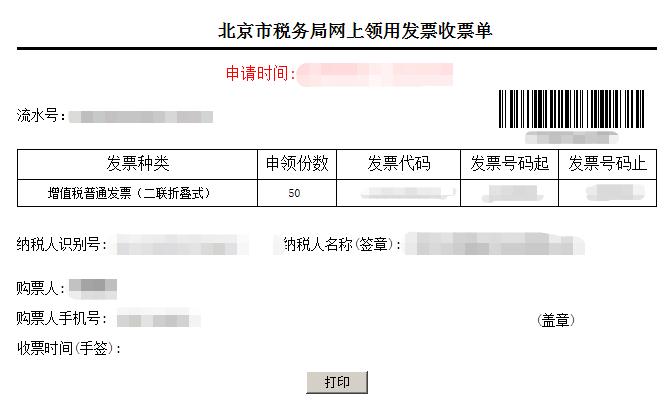

5. Print the bill receipt

When the "Business Status" changes to "Package Picking Completed, Delivery Started", you can print the "Invoice Receipt Form for Online Collecting of Beijing Taxation Bureau" through the button in the operation bar of the page. The printed bill receipt needs to be stamped with official seal or special seal for invoice. When distributing the invoice, you need to receive the ticket with this receipt.

6. Sign the physical invoice

The delivery staff will contact you through the mobile phone number when submitting the application. When signing, please show the Invoice Receipt Form for Online Receipt of Invoice from Beijing Taxation Bureau, and check the invoice code and invoice number of the physical invoice. After confirmation, please give the stamped ticket receipt to the delivery staff.

END

This article was published by Yizhuang, Beijing.

Please indicate the source for reprinting.

The news comes from Beijing Economic Development Zone Taxation Bureau.

Original title: "From June 1st, tax invoices can be delivered home free of charge without queuing"

Read the original text